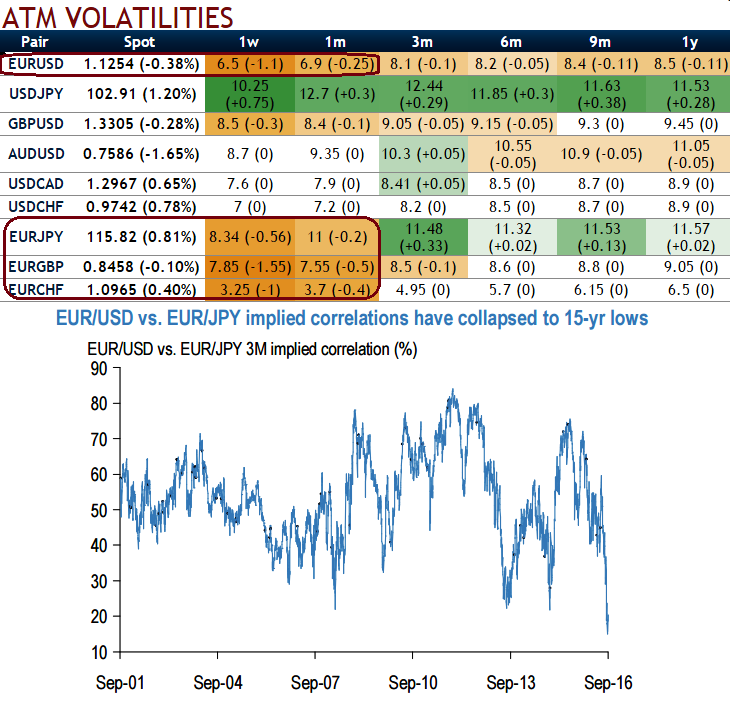

In correlation space, around 20% (see above chart), with USDJPY vols having taken off since early June in anticipation of the September BoJ meeting even as EURUSD and EURJPY vols have floundered.

One interpretation of this extreme set-up is that the option market now assigns a degree of equivalence to this month’s ECB and BoJ policy meetings, expecting both to over- or (more likely) under-deliver on monetary easing.

If EUR and JPY were to both strengthen in response to timid policy moves, that would justify a higher price for correlation between them and muted expectations for the EURJPY cross, hence the correlation between a potentially stronger EURUSD and a likely sideways EURJPY has collapsed to something approaching zero.

This is in agreement with our risk bias of disappointment out of both the ECB and the BoJ, and we are positioned accordingly in our vol portfolio via short delta-hedged risk-reversals in EURUSD and EURJPY (long EUR calls vs. short EUR puts in both).

The multi-sigma extended nature of the above chart, however, raises the question of whether most, if not all, of this expectation, is now in the vol price, and if it might be prudent to mitigate some of that risk when hedges are this cheap.

Buying correlation swaps are not the answer, not only because of their illiquidity, but also because recent realized correlations have been clocking a very painful 15-20 % points under even current depressed implied correlations.

One alternative to the pure correlation construct is to own the EURJPY.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices