EURUSD underlying movements:EURUSD is extending the sharp reversal from 1.1800-1.1850 range high resistance. Focus, for now, is on whether support in the 1.1525-1.1450 can hold this decline for at least a recovery back towards 1.1650, if not another re-test of 1.1800-1.1850. Failure to hold this support sees 1.1405-1.1390 as final support ahead of the 1.1300 previous reaction lows.

We have been looking for a corrective range to expand up to 1.20-1.21 levels in the intermediate trend, before testing 1.12-1.10 support. The risk is that 1.1850 actually defines the top of that range.

On a broader perspective, we still believe 1.0350 was a major low. As such price action under 1.2600 is viewed as corrective, but ongoing with the risk of a move back to the 1.12-1.10 region, before developing a higher low.

The euro remains under pressure amid concerns about the Italian budget. Italian bond yields rose to their highest level in four years after EU commission head Juncker warned of the danger of Greek-style crisis. Reports suggest that the Italian budget will be discussed by the EU parliament on 15thof this October.

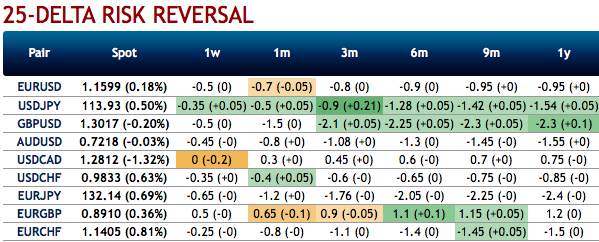

OTC Outlook: Please be noted that the positively skewed IVs of EURUSD of 1m tenors signify the hedging interest of bearish risks.

While Risk Reversal numbers of 1m tenor indicate mounting downside risks, while bearish risk sentiment remains intact in the long-run (refer long-term risk reversal numbers).

Well, contemplating above-stated driving forces and OTC indications, options strips strategy is advocated on both trading as well as hedging grounds. The options strips strategy which contains 3 legs needs to be maintained with a view to arresting price downside risks.

Option Strategy: Options Strips

Combination ratio: (2:1)

Rationale: Considering the bullish (in near-term) and bearish technical environment (in long-term) and most importantly, the skews in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with bearish risk reversal numbers.

The execution: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 1M tenors, go long 1w at the money +0.51 delta call option simultaneously.

The strategy can be executed at net debit with a view to arresting FX risks on both sides and likely to derive exponential returns but with more potential on the downside. Courtesy: Lloyds bank

Currency Strength Index:FxWirePro's hourly EUR spot index is inching towards -129 levels (which is bearish), while USD is flashing at 113 (which is bullish), while articulating at (09:42 GMT). For more details on the index, please refer below weblink:

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate