We reckon that the major uptrend of EURSEK and the abrupt bear swings could be efficiently tackled by the below option strategy.

As shown in the diagram, the ATM IVs of this pair have been an extremely lower side which is perceived to be beneficial for the call option writers considering the on-going technical trend.

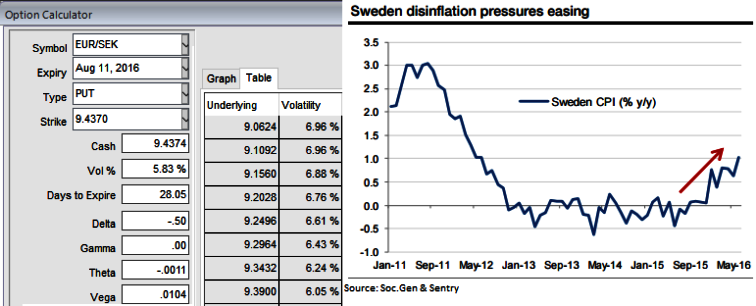

It is time to buy Swedish krona for the late summer crayfish season. SEK should do well against EUR with disinflation pressures gradually easing in Sweden and global risk sentiment recovering sharply. The krona remains cheap from a long-term valuation perspective, and should continue to support Swedish growth even if it strengthened moderately from here.

Keeping the above both fundamental factors in mind, it is advisable to go long in 1M (1%) OTM 0.36 delta call while writing 1W (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), the credit call spread option trading strategy is recommended when the underlying spot of EURSEK is anticipated to drop moderately in the near term and spikes up in long term.

Trade expects that the underlying gold spot price would drop to ITM strikes on expiration and thereafter bounce back again.

Thereby, you are speculating the EURSEK spot struggle in the short run by shorting, and hedge any dramatic upside risks in the long term via longs in OTM strikes which is why we've used diagonal expiries.

Margin: Yes for ITM shorts.

Return: The return is limited by ITM shorts. No matter how far the market moves below that point, the profit would be the maximum to the extent of initial premiums received.

BEP: The break-even point lies between ITM and OTM strikes.

The Swedish krona should do well with disinflation pressures gradually easing in Sweden and global risk sentiment recovering sharply. The Brexit vote in the UK and the resulting revision of the Riksbank’s rate path to indicating a delay to a rate hike into the second half of 2017 have hurt SEK in recent weeks.

But the underlying fundamental strength of the Swedish economy has not been damaged significantly. Moreover, SEK remains cheap from a long-term valuation perspective, and should continue to support Swedish growth even if it strengthened by a few percentage points.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty