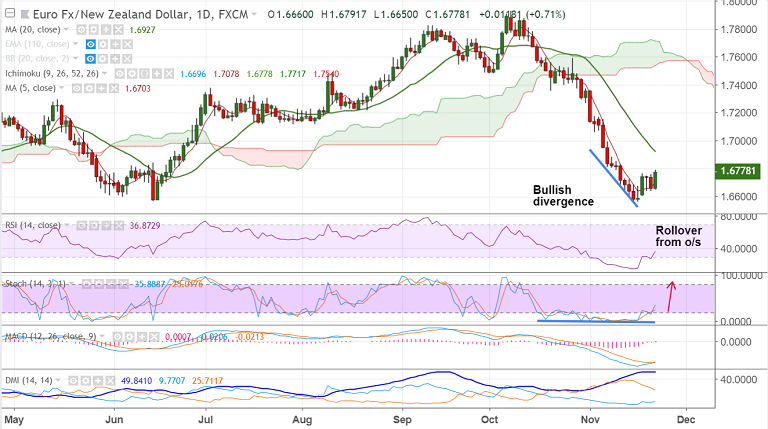

EUR/NZD chart on Trading View used for analysis

- EUR/NZD spikes higher on the day as markets await ECB minutes later in the day.

- The pair is trading 0.73% higher a 1.6780 at the time of writing, bias higher.

- Price action has broken above 5-DMA and on the weekly charts, the pair has retraced dip below 110-EMA.

- We see a turn in 5-DMA which is now biased north and bullish divergence on Stochs adds to the bullish bias.

- Stochs and RSI are on verge of rollover from oversold levels and MACD is on verge of bullish crossover on signal line.

- The kiwi is sold-off across the board today. Focus now on ECB minutes.

- If the minutes downplay the recent slowdown in the economy and Italy concerns and reaffirm commitment to end the QE program in December, we may see further upside.

- Scope then for test of 20-DMA at 1.6928. Bullish invalidation likely on retrace below 110W EMA at 1.6660.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Iran Unrest Sparks Oil Rally — Bounce Off EMA, Buy Dips to $66.40 Glory

Iran Unrest Sparks Oil Rally — Bounce Off EMA, Buy Dips to $66.40 Glory  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  NZDJPY Bulls in Control: Buy-the-Dip Setup Points to 96 Target

NZDJPY Bulls in Control: Buy-the-Dip Setup Points to 96 Target  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes