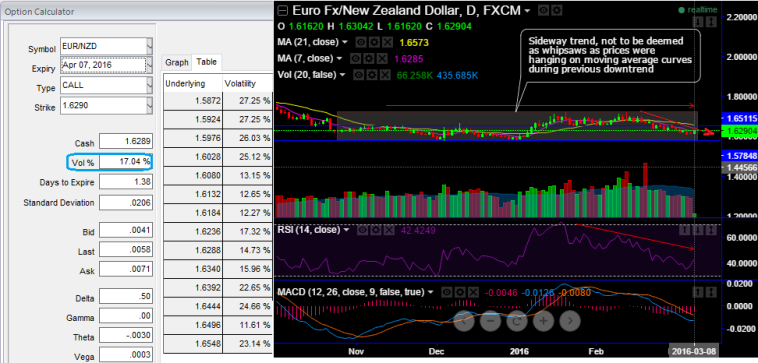

Technical glimpse: Please observe the Euro's lacklustre movements against Kiwi dollar, it (EURNZD) has been creeping sideways to become an underperformer from last couple of trading sessions.

Especially from 20th January, EURNZD dropped almost 5.75% from the recent highs of 1.7273 to the current 1.6275, current prices have slid below 7 & 21DMA.

On a broader perspective, It had broken crucial supports at 1.7068 levels during October in last year, it is now acting that as a stiff resistance, we've seen failure swings at this juncture from last two months.

Moving onto the FX option market, we think ATM IVs of 1M expiries of this pair are at extremely higher side (17.04%) contemplating the sideway trend that is prolonging from last couple of weeks.

If these vols and prices of ATM calls are quoted for standard moneyness levels for different time to expiry periods, then we reckon this as an opportunity for shorting such ATM calls considering the above technical reasoning.

The standard moneyness levels are At the money level, 25 delta out of the money level and 25 delta in the money level (75 delta) .

Since out of the money levels are liquid moneyness levels in the options market, market quotes these levels as 25 delta call and 25 delta put . Having said that if a hedger has the FX exposure in this pair, he can build the below strategy of diagonal tenors capitalizing on implied volatility advantage for any time to expiry by using the three points in the volatility surface.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute: Go long 1M At the money delta Call, Go long 3M at the money delta put and simultaneously, Short 3M (1.5%) out of the money call with positive theta.

FxWirePro: EUR/NZD moves sideways to bearish, IVs overreact - hedge via 3 way straddle versus call

Tuesday, March 8, 2016 6:45 AM UTC

Editor's Picks

- Market Data

Most Popular