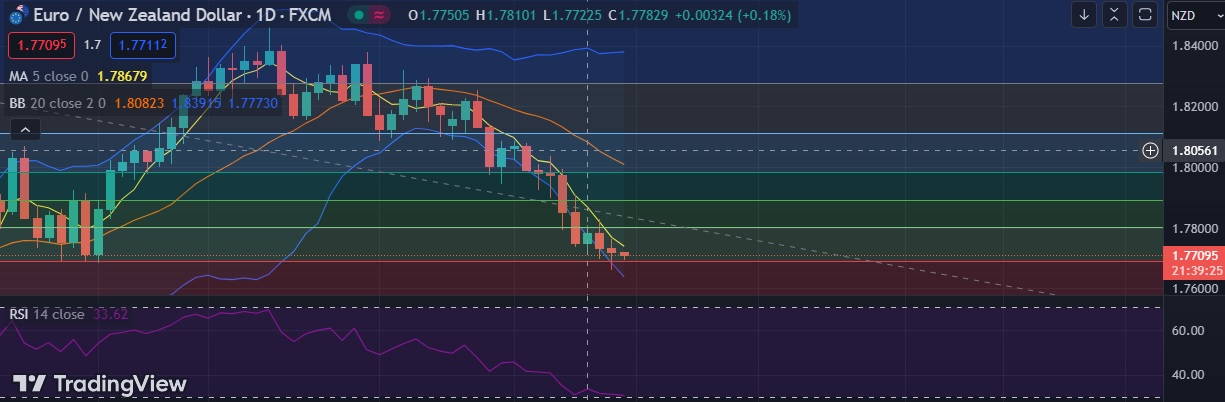

• EUR/NZD declined on Thursday as the pair extended weakness on worries over higher interest rates and crude prices.

• A fresh bearish signal emerged today as EUR/NZD down trend extended, Break 23.6% fib will bring 1.7650/1.7600 zone into focus.

•Technical signals show the pair could lose more ground in the short-term as RSI is at 61 bearsih, daily momentum studies 5, 9 and 11 DMAs are trending up.

• Immediate resistance is located at 1.7740(5DMA), any close above will push the pair towards 1.7806(38.2% fib).

• Strong support is seen at 1.7690(23.6% fib) and break below could take the pair towards 1.7650(Lower BB)

Recommendation: Good to sell around 1.7710, with stop loss of 1.7860 and target price of 1.7630