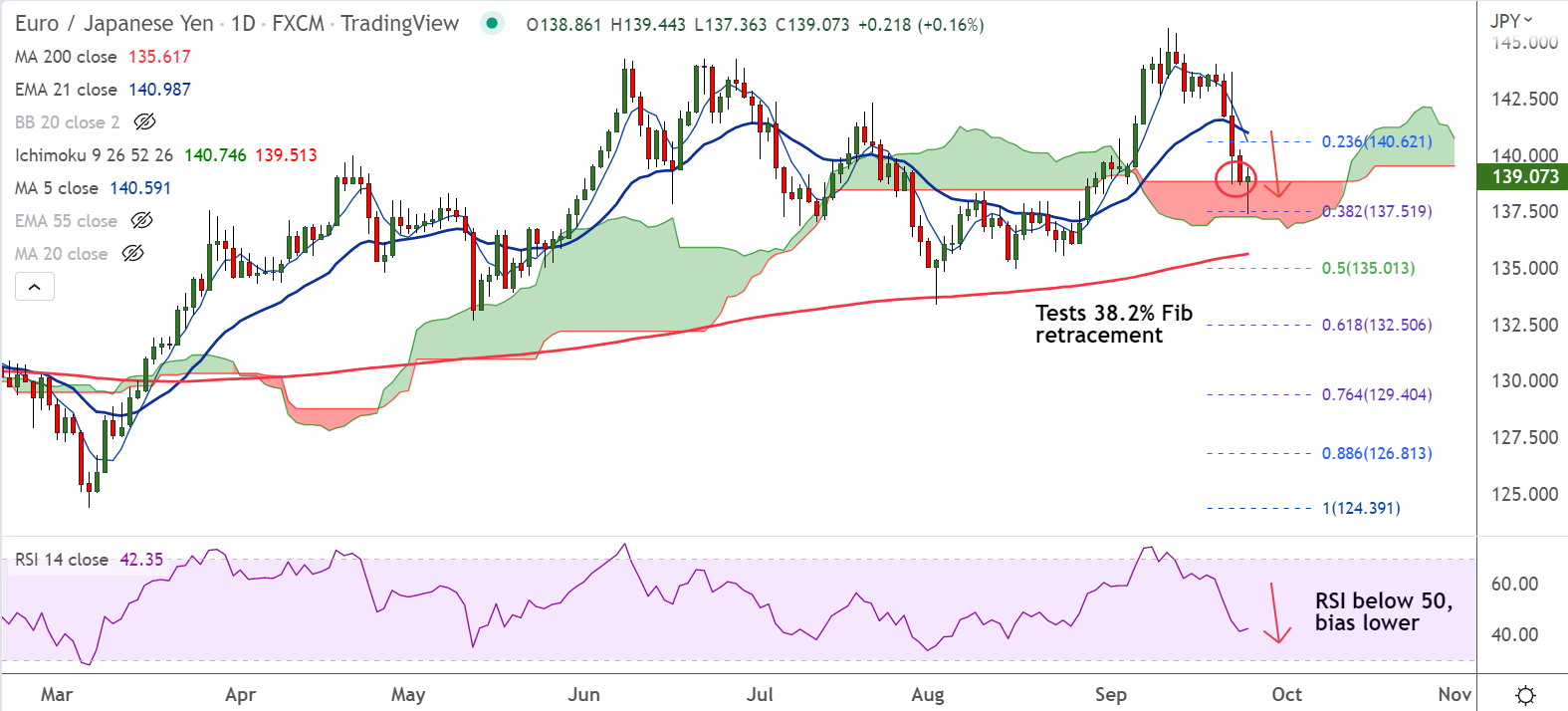

Chart - Courtesy Trading View

Spot Analysis:

EUR/JPY was trading 0.02% higher on the day at 138.89 at around 10:20 GMT.

Previous Week's High/ Low: 144.04/ 138.66

Previous Session's High/ Low: 140.25/ 137.36

Fundamental Overview:

German IFO sentiment indexes disappoint in September, fall more than expected.

Headline German IFO Business Climate Index fell to 84.3 from 88.5 in August, missing market expectation at 87.1.

The Current Assessment Index slipped to 94.5 from 97.5 and the Expectations Index declined to 75.2 from 80.3.

Technical Analysis:

- EUR/JPY dips into the daily cloud, tests 38.2% Fib retracement

- Volatility is high and momentum is bearish. MACD and ADX support downside in the pair

- Bearish 5-DMA crossover on 20-DMA adds to the downside bias

- Price action is below 200H MA and GMMA has turned bearish on the intraday charts

Major Support and Resistance Levels:

Support - 137.36 (38.2% Fib), Resistance - 139.83 (55-EMA)

Summary: EUR/JPY hovers above 110-EMA and cloud top support. Decisive break below will drag the pair lower.