We’ve already highlighted in our recent write ups on richness in EURJPY skews.

For more reading on EURJPY IV skews, please follow below web links:

Accordingly, we had also advocated directional trades: Buy EURJPY 6m topside seagull strikes 114/123.5/128 Zero cost (indicative offer, spot ref: 122.59).

This was advocated coupling with reasonable trade risks: unlimited below 114, the structure is buying a standard call spread strikes 123.5/118 fully financed by selling a put strike 114. As such, investors face unlimited downside risk at the expiry if EURJPY trades below 114.

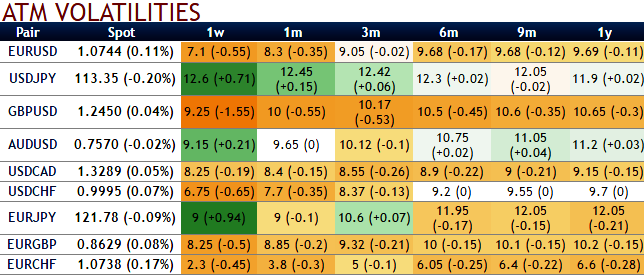

For now, please be noted that the OTC indications of 1-3m combinations are the most conducive for the construction of put ratio back spreads.

Because the risks reversal bidding for higher prices in underlying EURJPY spot FX with downside risks in long run (3m RR). 1m IVs are shrinking away while 3m IVs rising, we interpret this as the options with a higher IV cost more. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good. Unfortunately, if you have sold an option, it is bad. A seller wants IV to fall so the premium falls. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

Traders tend to view the put ratio back spreads as a bear strategy because it employs puts. However, it is actually a volatility strategy.

So entering the position when implied volatility is high and waiting for the inevitable adjustment is a smart approach, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a “price neutral” approach to options, and one that makes a lot of sense.

Hence, one could write 1m ITM put options, while adding longs in 3m ATM or OTM put options simultaneously.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data