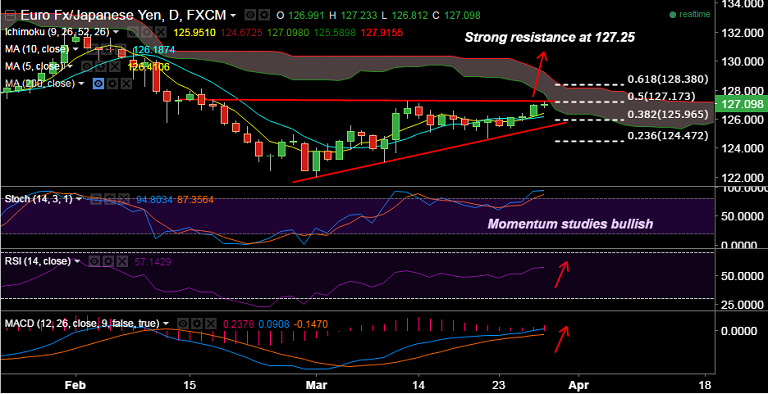

- EUR/JPY edges higher on the day, but remains capped below strong trendline resistance at 127.25.

- Breaks above will see further upside, gains till 127.78 (daily cloud base) then likely.

- Techincals on daily charts support upside in the pair. However, Stochs have approached overbought territory so caution advised.

- Pair finds resistances at 127.25 (trendline), 127.39 (Feb 17th highs) and then 127.78 (cloud base).

- On the downside supports are aligned at 126.62 (double bottom Feb 16th & 17th), 126.42 (5-DMA) and 126.20 (10-DMA).

- On the data markets await euro area's February’s M3 Money Supply and Private Loans figures.

- Yellen's speech due later in the NY session will also be in focus for further cues on Fed hikes which could impact risk appetite.

- Our previous call (http://www.econotimes.com/FxWirePro-EUR-JPY-edges-lower-from-session-highs-at-12686-momentum-higher-good-to-buy-dips-185039) has hit targets 1&2.

Recommendation: Book partial profits, raise trailing stops to 126.60, TP: 127.40/127.75