- EUR/JPY is extending winning streak into the 4th straight week, bias remains bullish.

- The pair has ignored a Doji formation on the daily candle on Friday's trade.

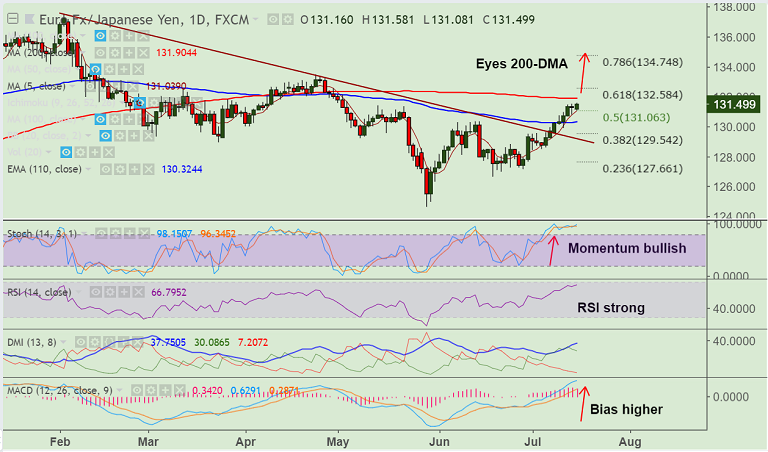

- Price action pushes higher from session lows at 131.08 as pair holds 5-DMA support at 131.03.

- Technical indicators support upside in the pair, scope for test of 200-DMA at 131.90.

- Momentum with the bulls. RSI strong above 65 levels, MACD and ADX support trend higher.

- Price action has broken above 110-EMA and is holding above 50% Fib retracement.

- Next major resistance lies at 200-DMA at 131.90. Break above to see further upside till 61.8% Fib at 132.58.

- On the flipside, 5-DMA at 131.03 is immediate support. Break below 110-EMA will negate bullish bias.

Support levels - 131.06 (nearly converged 5-DMA and 50% Fib), 130.32 (110-EMA), 130

Resistance levels - 131.90 (200-DMA), 132, 132.58 (61.8% Fib)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-EUR-JPY-edges-lower-from-7-week-highs-at-13060-bias-higher-stay-long-on-dips-1400944) has hit TP1/2.

Recommendation: Book partial profits, trail SL to 130.55, hold for 131.90/ 132/ 132.55

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at 94.77 (Bullish), while Hourly JPY Spot Index was at -105.632 (Bearish) at 0600 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.