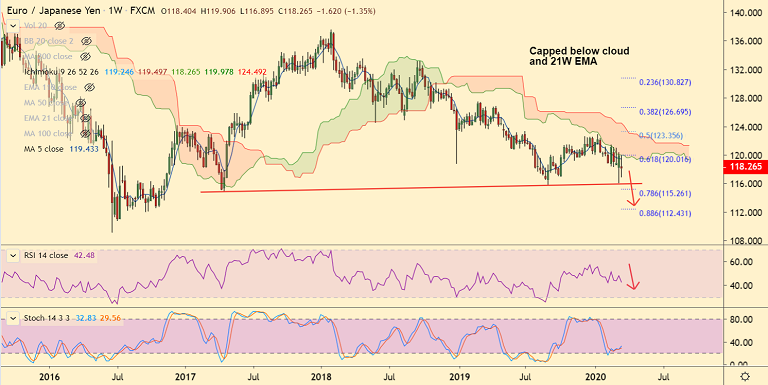

EUR/JPY chart - Trading View

Euro under pressure post-ECB plan. Markets remain sceptical after the ECB announced an extra €750 billion stimulus package late on Wednesday.

The central bank is set to run an asset purchase programme (called the Pandemic Emergency Purchase Programme – PEPP) until at least the end of 2020 (or until the COVID-19 subsides).

Under this programme, the ECB will purchase usual eligible assets under the existing QE as well as non-financial commercial paper and also Greek sovereign debt.

Downbeat catalysts in the form of lower than expected Japan’s CPI and BOJ minutes favoring further easing weighed on the yen.

EUR/JPY edged higher on the day to hit session highs at 119.324, but has since erased most of the gains to trade at 118.23 at around 11:00 GMT.

Major and minor trend for the pair are bearish. Price action is capped below weekly cloud and 21W EMA. Momentum is bearish and RSI is below 50.

Resumption of downside likely. Next bear target lies at 116 (trendline) ahead of 78.6% Fib at 115.26.

Support levels - 116 (trendline), 115.26 (78.6% Fib)

Resistance levels - 119.73 (55-EMA), 120.07 (200-DMA)

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch