Chart - Courtesy Trading View

Spot Analysis:

EUR/JPY has erased some initial losses and has edged higher from session lows at 139.93.

Previous Week's High/ Low: 141.93/ 140.08

Previous Session's High/ Low: 142.29/ 140.46

Fundamental Overview:

Final Services PMIs in Germany and the euro area printed at 50.7 and 50.8, respectively, for the month of January.

The ECB published its Survey of Professional Forecasters and now see HICP higher in 2023 and 2024 while Real GDP growth expectations appear largely unchanged.

On the other side, Japan Jibun Bank Services PMI (Jan) dropped marginally to 52.3 from the former release of 52.4.

Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Friday, “BoJ must maintain ultra-easy policy to support the economy and create an environment for firms to hike wages.”

Kuroda said that he “expects wages to rise quite significantly due to a very tight job market.”

Technical Analysis:

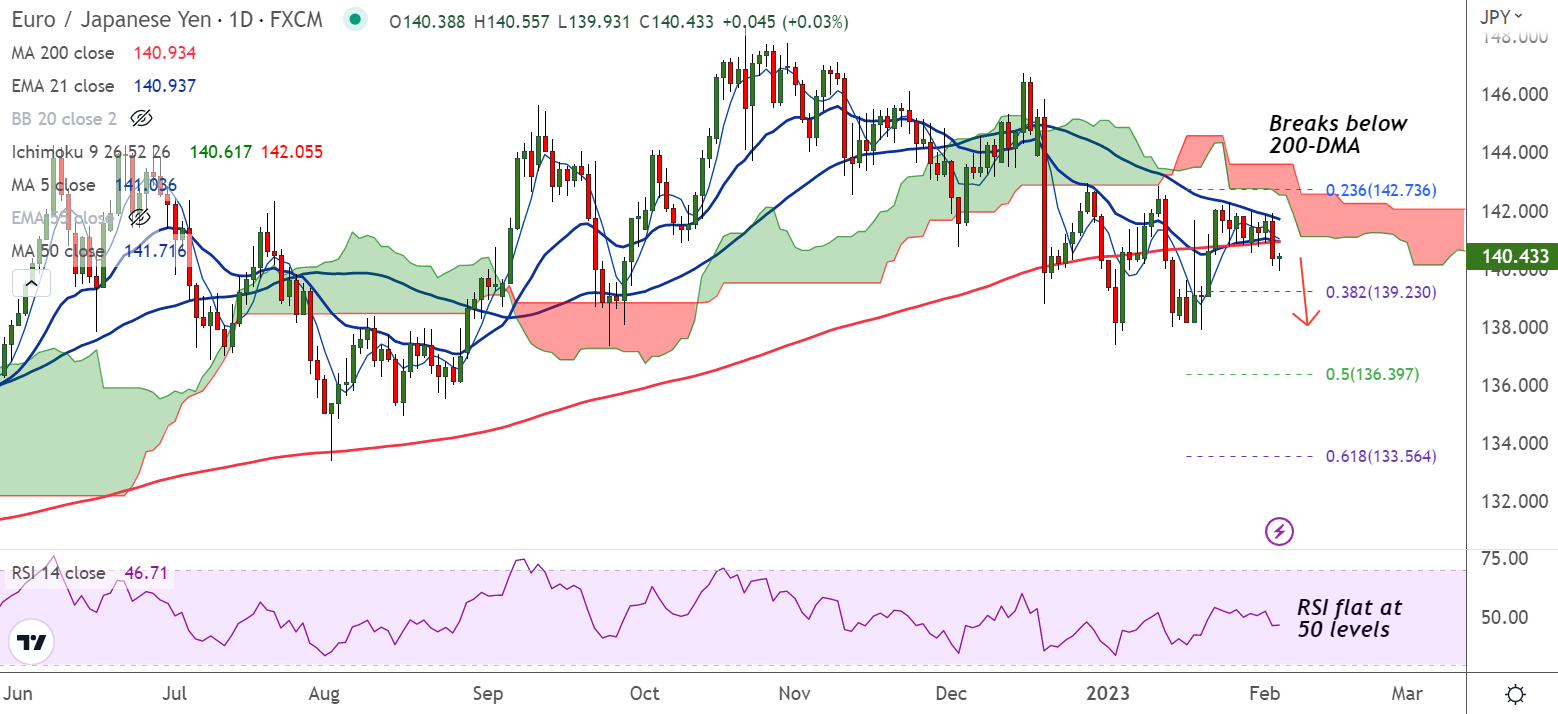

- EUR/JPY has retraced below 200-DMA, the pair is consolidating below

- Price action is below 200H MA and GMMA indicator has turned bearish on the hourly charts

- MACD is on verge of bearish crossover on signal line, ADX supports downside

- Price action is below cloud and Chikou span is biased lower

Major Support and Resistance Levels:

Support - 139.23 (38.2% Fib), Resistance - 140.93 (200-DMA)

Summary: EUR/JPY bias remains bearish as long as pair remains capped below 200-DMA. Scope for test of 38.2% Fib at 139.23. Bearish invalidation only above 200-DMA.