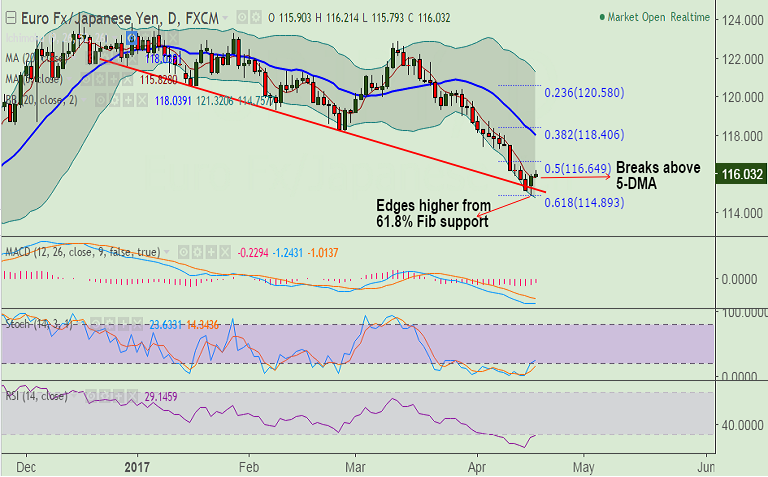

- EUR/JPY pares some losses from fresh 2017 lows at 114.85 to retake 116 handle.

- The pair has broken above 5-DMA at 115.84, close above could see more upside.

- Technical indicators do not show signs of reversal. RSI and Stochs are deeply in oversold territory.

- The pair is currently holding support at 61.8% Fib and only break below will see further downside.

- Heightened North Korea tensions could see risk-off tone worsen as the week progresses, keeping safe-haven assets well in demand.

Support levels - 115.84 (5-DMA), 115.20 (trendline), 114.89 (61.8% Fib retrace of 109.205 to 124.094 rally)

Resistance levels - 116.65 (50% Fib), 117, 117.78 (200-DMA), 118.03 (20-DMA)

TIME TREND INDEX OB/OS INDEX

1H Neutral Neutral

4H Neutral Neutral

1D Neutral Oversold

1W Bearish Neutral

Recommendation: Watch out for close above 5-DMA to go long, SL: 115.25, TP: 116.45/ 116.65/ 117

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at 102.027 (Bullish), while Hourly JPY Spot Index was at -69.8741 (Neutral) at 0730 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.