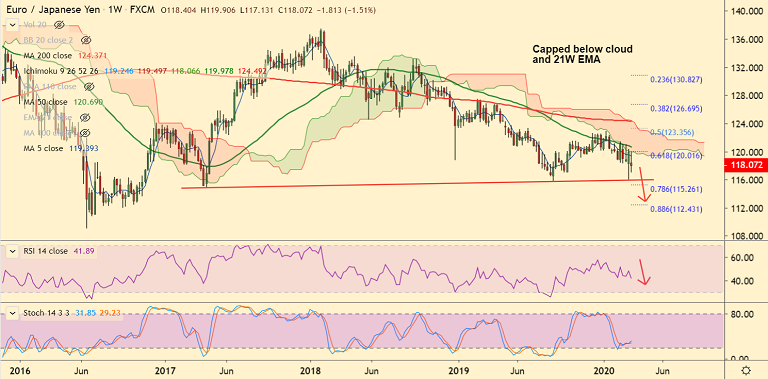

EUR/JPY chart - Trading View

EUR/JPY has failed to sustain Friday's massive gains. Upside has been capped at 200-DMA which is stiff resistance (currently at 120.10).

After a few extremely volatile sessions, the pair is currently trading 0.30% lower on the day at 118.03 at around 10:40 GMT.

Back-to-back long-legged Dojis on the daily charts suggests selling pressure and highs.

Major and minor trend for the pair are bearish as evidenced by the downward sloping moving averages in the GMMA indicator.

Price action is capped below weekly cloud and 21W EMA (currently at 120.057). Momentum is bearish and RSI is below 50.

Resumption of downside likely. Next bear target lies at 116 (trendline) ahead of 78.6% Fib at 115.26.

Support levels - 116 (trendline), 115.26 (78.6% Fib)

Resistance levels - 119.02 (21-EMA), 120.10 (200-DMA)

Recommendation: Good to stay short on upticks around 118.20-118.60, SL: 120.00, TP: 117.70/ 117/ 116.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data