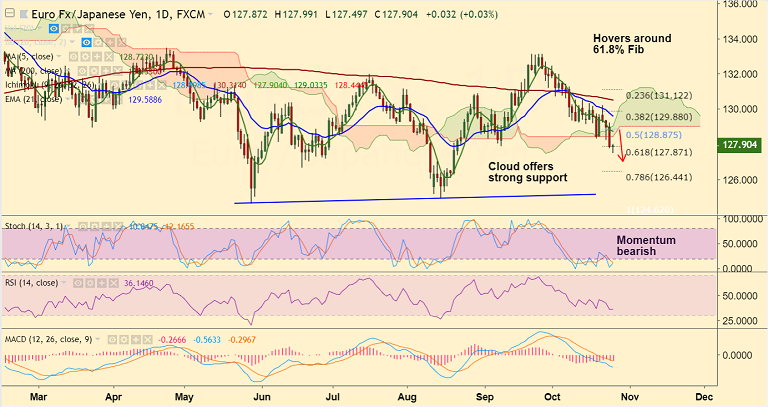

EUR/JPY chart on Trading View used for analysis

- The single currency remians under pressure heading into today's ECB October monetary policy meeting due at 1145 GMT.

- EUR/JPY hit session lows at 127.50 before paring some losses to currently trade at 127.83.

- Analysts expect the ECB to leave policy on hold, and to provide no new information regarding the conclusion of QE later this year.

- Focus will be on the tone of the press conference, as Draghi is likely to acknowledge that downside risks have somewhat intensified.

- EUR/JPY trades with a bearish bias, technicals support downside. Scope for test of 78.6% Fib at 126.44.

Call update: Our previous call (https://www.econotimes.com/FxWirePro-Euro-weakens-across-the-board-after-dismal-PMI-data-stay-short-EUR-JPY-target-618-Fib-1447982) has hit TP1.

Recommendation: Book partial profits at lows. Holds for further downside.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  FxWirePro-Major European Indices

FxWirePro-Major European Indices  AUDJPY Smashes 30-Month Peak — Buy the Dip, 112 in Sight

AUDJPY Smashes 30-Month Peak — Buy the Dip, 112 in Sight  FxWirePro: EUR/AUD bearish as RBA hike boosts Australian dollar

FxWirePro: EUR/AUD bearish as RBA hike boosts Australian dollar  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  EURJPY Breaks Above 184 – Euro Bulls Charge Toward 187

EURJPY Breaks Above 184 – Euro Bulls Charge Toward 187  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  EUR/JPY Powers Higher for 2nd Day — Bulls Charge Toward 187+ Breakout

EUR/JPY Powers Higher for 2nd Day — Bulls Charge Toward 187+ Breakout  Iran Unrest Sparks Oil Rally — Bounce Off EMA, Buy Dips to $66.40 Glory

Iran Unrest Sparks Oil Rally — Bounce Off EMA, Buy Dips to $66.40 Glory  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One