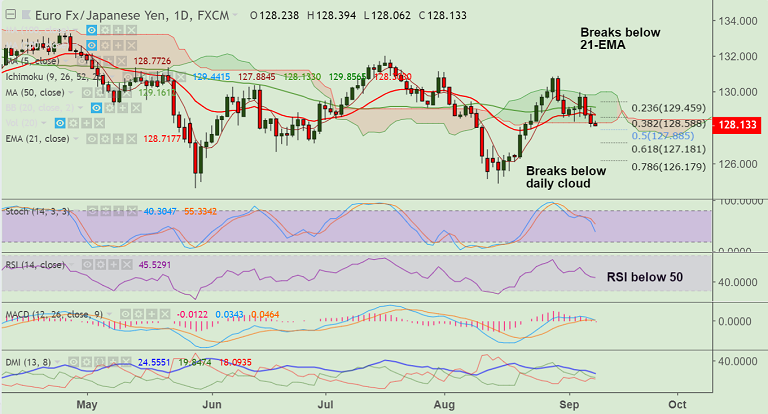

EUR/JPY chart on Trading View used for analysis

- EUR/JPY has broken below 21-EMA support and has slipped below daily cloud.

- The single currency dampened after Fitch downgraded Italy's debt outlook to negative earlier in the month.

- Downside in the pair remains intact, technical studies are biased lower.

- We evidence a 'Bearish Engulfing' pattern on the daily charts and a 'Shooting Star' on the weekly charts which keeps downside bias in the pair intact.

- Downside is holding above 128 handle, break below eyes 61.8% Fib at 127.18. Further weakness likely on break below.

- On the flip side, we see stiff resistance at 128.77 (nearly converged 5-DMA and 21-EMA). Breakout could see further upside. Bearish invalidation only above 200-DMA.

Support levels - 127.88 (50% Fib), 127.18 (61.8% Fib) 127

Resistance levels - 128.71 (21-EMA), 128.77 (5-DMA), 129.16 (50-DMA)

Recommendation: Stay short on break below 128 mark, SL: 128.75, TP: 127.20/ 127/ 126.17

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at -58.9465 (Neutral), while Hourly JPY Spot Index was at 121.484 (Bullish) at 0500 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.