Yet, short-lived impact of the surprise NIRP decision on the JPY raises questions on the efficacy of further easing to stem appreciation pressures and global risk dynamics will likely prevail as main driver of the JPY.

In terms of economic data, we look for Q4 real GDP (Monday) to show -0.3% q/q saar (consensus: -0.8%) after +1.0% growth in Q3, with domestic private demand dragging down the overall growth in addition to subdued external developments and public demand.

While we view further downside risk in USDJPY ahead, the pair remains highly prone to fluctuations in global risk sentiment and speculations about further BoJ easing or FX intervention may also add two-way volatility in the near term. Volatility of inventory investment poses downside risk to our forecast as well. EURJPY can't be spared aside from Yen's gains.

Elsewhere, we expect December Machinery Orders (Wednesday) to have increased +7.7% m/m (consensus: +4.6%) and look for January Trade Balance (Thursday) to show JPY-782bn of deficit (consensus: -647bn).

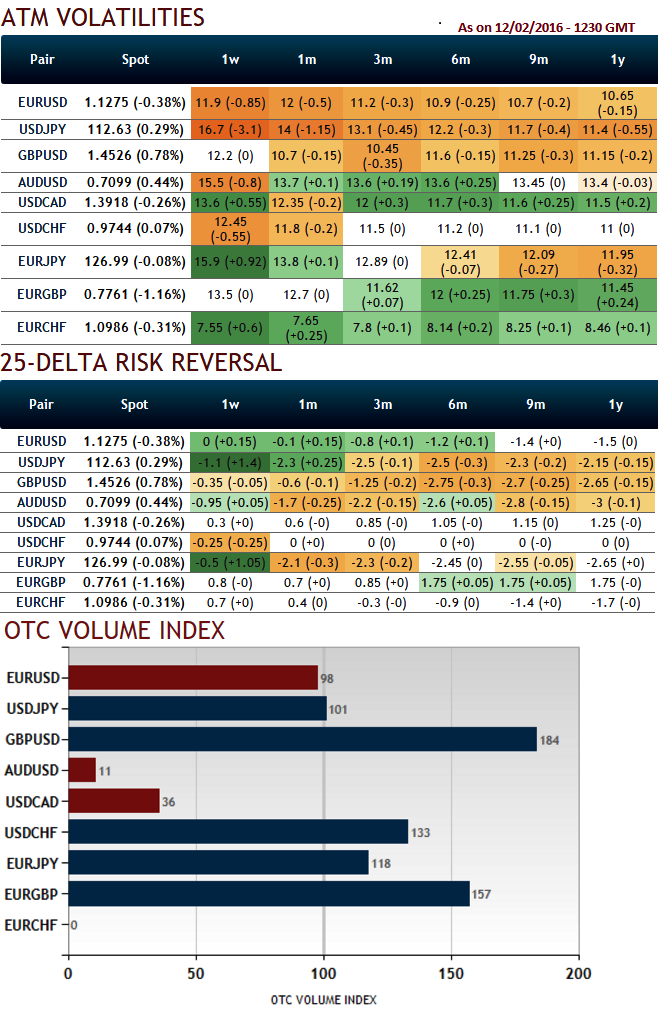

Please be noted that the risk reversal numbers in long run that indicate downside risk sentiments in this pair, rising implied volatilities to justify these positions and OTC VIX is matching with these computations. Contemplating all these aspects (macroeconomic trend, BoJ's policy measures, risk reversal and volatility indications) we eye on put ratio back spreads to hedge the potential downside risks.

Hence, at the current spot FX is trading at 127.514, we recommend going in long in ATM -0.49 delta put and (1%) OTM -0.31 delta put and simultaneously short (1.5%) ITM puts with positive theta and shorter expiries as the pair has been showing more selling momentum, we maintain our earlier targets extending dips up to 126.750 sooner and even at 125.750 levels in near terms. It is understood that bearish momentum is bolstering as we saw that from delta risk reversal table. Hence, aggressive bears can initiate strategy using ATM puts.

Since the option you sell will always be lower on the skew curve it means you are getting a better deal on what you are selling compared to what you are buying. It makes this strategy a good one if the skew is running a little hot but EURJPY hasn't rolled over that much.

FxWirePro: EUR/JPY OTC intensifies hedging sentiments, deploy back spreads to hedge downside risks on yen's data season

Monday, February 15, 2016 8:45 AM UTC

Editor's Picks

- Market Data

Most Popular