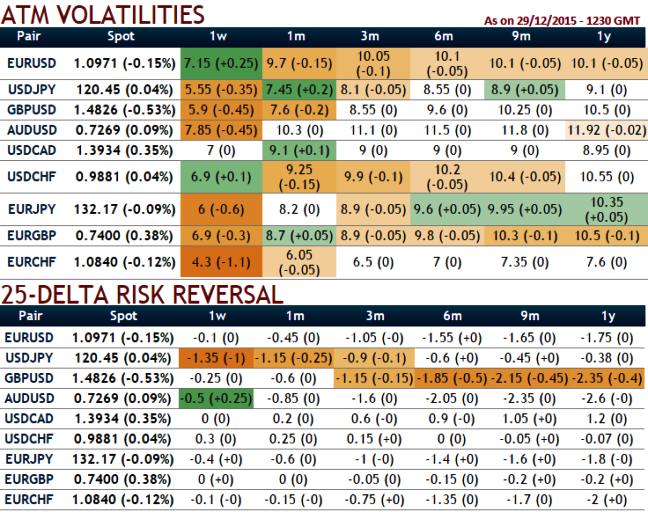

Please observe the IV factor for ATM contracts with 1w-1m expiries that is moving in tandem with negative risk reversals. It has been smoothening and stagnant from last fortnight or so 12.75% to 9.6% again from 9.6% to the current 7.5%.

This gradual increase in negative delta risk reversal numbers signify how the OTC market arrangements are positioned to mitigate the potential downside risks in a long run while IVs are also gradually increasing.

As we can very well understand the hedging activities of downside risks are mounting up, as a result Put options seem expensive.

Volatility smiles most frequently tells that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

Hence, with the current spot FX is trading at 131.628 and we will continue to remain bearish with near term targets extending dips up to 131.035 and then 129.50 levels.

Therefore, the recommendation for now is to add an extra-long on put with 1M expiry to any debit put spreads.

So, the strategy goes this way, long 2 lots of 1M ATM -0.49 delta put and simultaneously short 1 lot of 2D (0.5%) ITM puts with positive theta values (use shorter expiries on short side as stated in the strategy).

Alternatively, the risk averse can even deploy option strips as well.

With these narrow strike differences, the profit potential is greater, so that the ratio needed is also lower to profit on underlying movement.

Caution: If you think the pair is going to crash, you should be loading up on put buys in existing strategy. The total cost of the trade is going to be the difference between the prices of the two options.

FxWirePro: EUR/JPY IVs reducing but risk reversal in long run signals downside pressures – add extra ATM longs to debit put spreads

Wednesday, December 30, 2015 6:58 AM UTC

Editor's Picks

- Market Data

Most Popular