The JPY nominal effective exchange rate first declined to mark a low since early-February on May 22, and in late May, the JPY crosses have rapidly risen amid Italian political turmoil and higher concerns of a trade war and momentarily halted for now.

While the risk sentiment has driven JPY lately, fundamentals provide a partial offset. First, our economists expect a pick-up in global growth led by the US. Firm global growth will likely secure an environment where JPY remains weak as a funding currency.

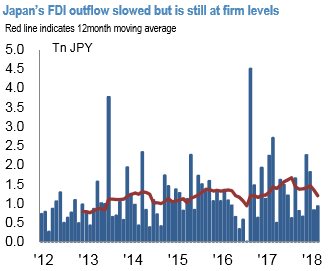

Also, Japan’s net outflow of FDI in 1Q was worth ¥3.6trn. This was 40% smaller than last year but still large in absolute terms (refer 1st chart).

And Japanese investors’ investments in foreign securities were firm from January to April (net purchase of ¥2.1trn foreign stocks and investment funds and ¥2.9 foreign bonds, refer 2nd chart).

Having said that, though Italian politics avoided a worst case, a slew of political events scheduled in coming weeks will still be important to JPY.

Relevant events include the US-North Korea summit (June 12), publication of the final list of Chinese imported goods on which the US will impose a 25% tariff (June 15) and the announcement of investment restrictions and enhanced export controls on China by the US (late June).

Sell 2M EUR/GBP vs. EUR/JPY corr swap, Monetizing re-emergence of idiosyncratic UK policy risk

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -10 levels (which is neutral). Hourly GBP spot index was at shy above 97 (bullish), and JPY is flashing -68 (which is bearish) while articulating (at 06:33 GMT).

For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures