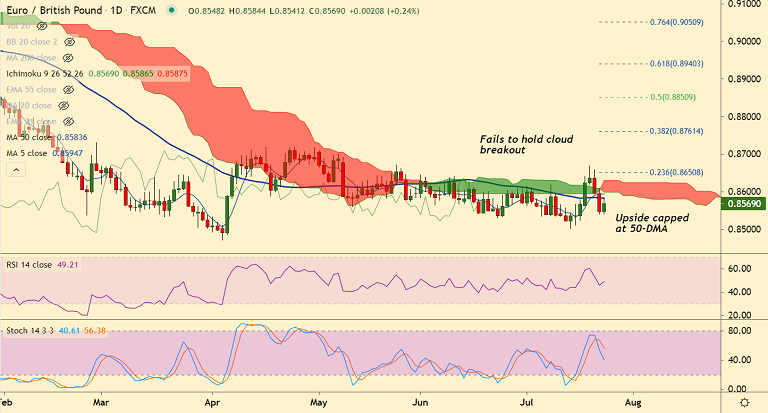

EUR/GBP chart - Trading View

Technical Analysis:

EUR/GBP was trading 0.20% higher on the day at 0.8565 at around 09:40 GMT.

The pair has slipped lower from session highs at 0.8584, erases upbeat eurozone PMI-led gains.

Upside was capped at 50-DMA which is offering stiff resistance at 0.8584, decisive break above to see further gains.

Major trend in the pair is bearish. Recovery failed to extend break above daily cloud.

Data Released:

Eurozone preliminary Manufacturing PMI arrives at 62.6 in July, beating estimates at 62.5.

The bloc’s Services PMI jumped to 181-month highs of 60.4 in July vs. 59.5 expected and 58.3 prior.

The IHS Markit Eurozone Composite PMI expanded further to 60.6 in July vs. 60.0 expected and 59.5 prior.

German Manufacturing PMI rose to 65.6 in July, while the services PMI came in at 62.2 for the reported month as against 59.1 estimated.

The headline UK Retail Sales recorded slightly better-than-expected growth of 0.5% in June. While the core sales figures increased by a modest 0.3% during the reported month.

Major Support and Resistance Levels:

Support - 0.8474 (110-month EMA), Resistance - 0.8584 (50-DMA)

Summary: Better-than-expected PMIs lend support to the single currency and help offset dovish ECB-led weakness. However, bearish technical bias weighs on the pair. Scope for test of trendline support at 0.8510 ahead of 110-month EMA at 0.8474.