The euro has been considerably downgraded again on the heels of a dovish

ECB and more poor growth data. German GDP contracted in 2Q as expected, and our economists have subsequently revised down their growth expectations for the coming year. They have simultaneously highlighted risks of more-aggressive-than-expected ECB policy support as well; we believe ECB dovishness is likely to remain a durable theme for the currency.

On the flip side, we mark down GBP considerably versus both EUR and USD (-2.4% and -4.6% respectively across the forecast horizon). Risks of a hard Brexit have not abated, and the macro picture continues to deteriorate.

We remain short in our portfolio as we have marked down EURGBP projections, our technical analysis also signal the pair is likely to prolong range-bounded trend in long terms and continue to suggest a significant pullback is warranted in short term, but price action is not confirming this at the moment. Short-term support lies at 0.9097 levels and resistance at 0.9161 levels. The pair is forecasted to oscillate but at 0.93 by year-end and even 0.95 in 2Q’20.

OTC Updates: Let’s just quickly glance at OTC outlook before looking at the options strategies.

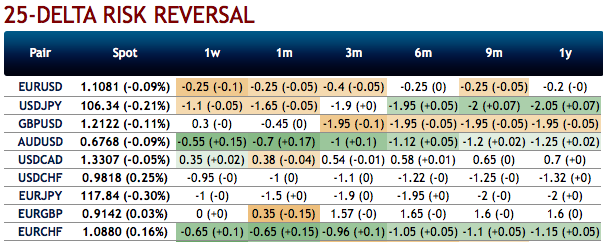

Bullish neutral risk reversals of EURGBP have been observed to the broader bullish risk outlook in the FX OTC markets, this is interpreted as the hedgers are still keen on bullish risks but with mild downside risk sentiment in the near-term (refer to negative risk reversals in 1m tenors which is absolutely in line with our forecasts).

While positively skewed IVs of 3-6m tenors have been indicating upside risks, more bids are observed for OTM calls than OTM puts. This is conducive for options holders of OTM call options.

While EURGBP risk reversals of the existing bullish setup remain intact, even if you see any abrupt negative risk reversal numbers, it should not be perceived as the bearish scenario changer. Instead, below options strategy could be deployed amid such topsy-turvy outlook.

Well, contemplating the above factors, 3-way options straddle versus ITM calls are advocated seem to be the most suitable strategy for EURGBP contemplating some OTC sentiments and geopolitical aspects.

Options Strategy: The strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 2m tenors, simultaneously, short (1%) ITM puts of 1w tenors. The strategy could be executed at net debit but with a reduced trading cost.

Hence, on hedging as well as trading grounds, initiate above positions with a view of arresting potential FX risks on either side but slightly favoring short-term bearish risks. Courtesy: Sentrix, JPM & Saxobank

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics