Swiss has produced an upbeat trade surplus numbers on the flip side. The healthy Swiss trade balance has printed at 2.87 billion which is well beyond market analysts' projections at 2.77 billion but below the previous flash at 3.58 billion.

The Swiss franc has continued to grind lower against the euro over the past month. In the absence of a significant drop in EUR/CHF below 1.0.

On an absolute PPP basis the franc looks overvalued by around 30% against the euro, but convergence to 1.40, above the pre-January floor of 1.20, looks like a challenge at this stage.

Policy makers seem satisfied for now with a gradual depreciation in the exchange rate. However, intervention pressure could mount, should the ECB extend or increase its QE programme.

For the time being monetary policy is set to remain on hold over our forecast period, with the deposit rate at -0.75%. We forecast the franc will continue to depreciate against the euro but not to fall below the 1.20 level over the next year, ending next year at 1.16.

Swiss National Bank leaves monetary policy unchanged, the SNB is leaving the target range for the three-month Libor unchanged at between -1.25% and - 0.25%. The interest rate on sight deposits with the SNB remains at - 0.75%.

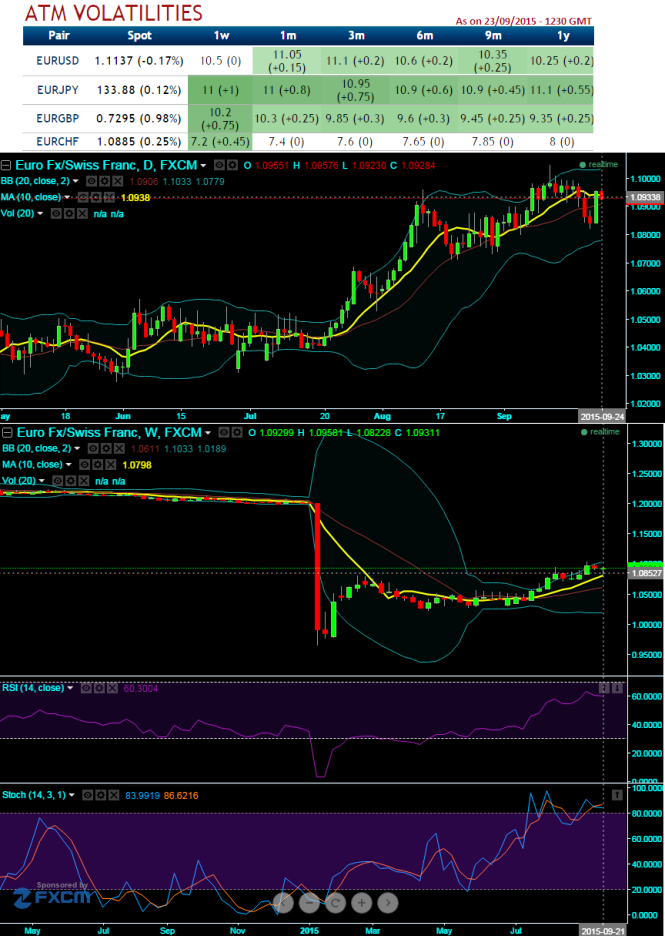

On technical grounds, after yesterday's sharp pull back, we predict marginal upswings on daily charts continue to persist with clear converging signals from RSI (14) and stochastic curves. Although there is no trace of drastic or dramatic movements on either side we still sense some sort of upward momentum.

As there are no significant data releases scheduled on CHF side for this week, for near future EURCHF may likely to experience low volatility, you can make out from the nutshell; EURCHF is to have the least IV among G10 currency space.

FxWirePro: EUR/CHF to maintain its uptrend in long term, Swiss trade not suffice to prop up currency

Thursday, September 24, 2015 11:36 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate