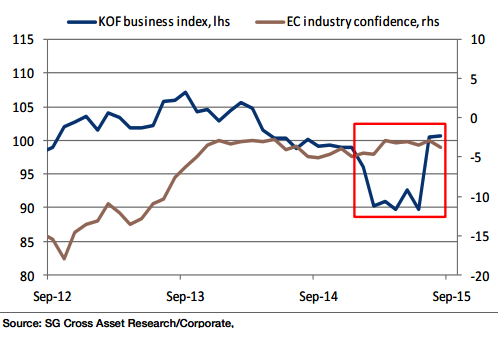

EUR/CHF hit a peak of 1.09615 in August, the highest level since the SNB abandoned the 1.20 floor in January. The risk aversion from global equities is boosting the EUR more than the CHF which is a break from previous trends (Franc ultimate safe harbour). Swiss CPI inflation also fell to a new low of - 1.3% in July, raising new questions over SNB policy.

"A delayed Fed rate increase (or a shallower US rate path) would further boost EUR/CHF as a realignment of short EUR vs USD continues and rate differentials narrow. The question for EUR/CHF is whether the ECB will respond with more QE", says Societe Generale.

SNB FX reserves hit a record 531.8bn CHF in July due to valuation effects (weak Franc boosts USD and EUR holdings). Domestic sight deposits fell last month to 396.03bn CHF.

Delayed Fed increase to boost EUR/CHF?

Friday, September 4, 2015 3:45 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed