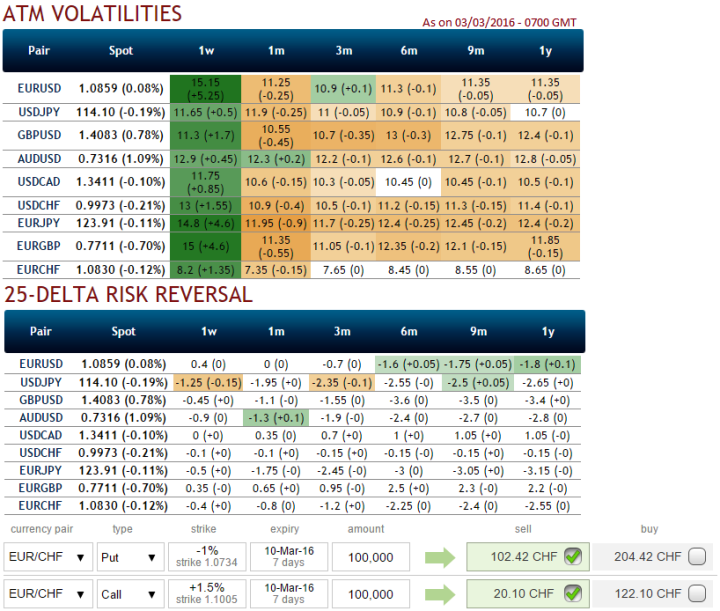

Delta risk reversals of EURCHF: From the nutshell, we understand that 25-delta risk of reversal of EURCHF has been one of the most expensive pairs to be hedged for downside risks as it indicates puts have been relatively costlier. As it showed the 3rd highest negative values which indicate downside risks of spot FX is anticipated and hedging for such risks is relatively more expensive.

The OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon as hedgers have been cautious on long term downtrend that has lasted since mid April 2013 and as a result delta risk reversal for AUDUSD was turning into negative.

Lower IVs of ATM contracts have been lacklustre and seems like huge disparity exists between option premiums and IVs as the 1W ATM puts have been priced 23% more than NPV which in turn a cause of concern as to whether spot FX would move in sync with risk reversals or not.

Option trade recommendation: Naked Strangle Sale

As the risk appetite varies from different investors to different traders, we've customized our formulation of strategies for such varied circumstances.

As we foresee narrow range trend is puzzling this pair on both intraday and weekly charts,

Please refer for more readings:

http://www.econotimes.com/FxWirePro-EUR-CHF-gravestone-doji-brings-rally-back-in-narrow-range-shrinking-volumes-ensure-range-10722-11011-171906

At current spot at 1.0840 with range bounded trend keeping in consideration we would like to remain in safe zone by achieving certain returns though shorting a strangle.

Short 1W OTM put (1% strike difference referring lower cap)and short OTM call simultaneously of the same expiry (1.5% strike referring upper cap) (preferably short term for maturity is desired).

Maximum returns for the short strangle is achieved when the EUR/JCHF price on expiry is trading at around 1.0840 or between the OTM strike as both the instruments have to wipe off worthless. So that the options trader gets to keep the entire initial credit taken as profit.

However, on a long term hedging perspective, relying risk reversal numbers debit put spreads are advocated as the selling indications are piling up on weekly graph. So buying In-The-Money Puts and to reduce the cost of hedging by financing this long position, selling an Out-Of-The-Money put option is recommended.

FxWirePro: EUR/CHF risk reversal signals weakness but tepid IVs suffice to restrain it in range - naked straddle shorts fetch certain yields

Thursday, March 3, 2016 9:59 AM UTC

Editor's Picks

- Market Data

Most Popular