Delta risk reversals of EURCHF for next 6 months: The OTC options market seemed to have been more well-adjusted on the direction for the pair over the 1m to 1y time horizon and as a result delta risk reversal for EURCHF was turning into negative.

From the nutshell, 25-delta risk of reversals of EUR/CHF the most expensive pair to be hedged for downside risks after AUDUSD as it indicates puts have been overpriced.

As it showed the highest negative values indicate puts are more expensive than calls (downside protection is relatively more expensive).

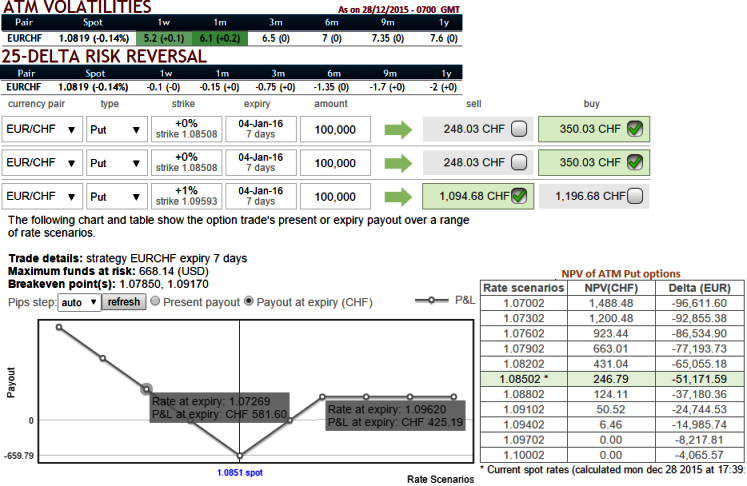

For instance, suppose we've constructed an at the money put option of EURCHF with 1W expiry and with this given maturity has reduced its implied volatility from 6.4% to 5.1% and it is likely to remain on lower side (historically these vols have never disappointed), whereas ATM puts are overpriced about 40% more than NPV. So with this disparity we like to advocate below spreads and combinations so as to gain the cost advantage.

With the above risk reversal reasoning, we recommend arresting further downside risks of this pair by Put Ratio Back Spread instead of strips which involves extra cost.

Strips employs an ATM call along with the puts double the size of call, but in the above explained scenario we think those who so are so bearish in long run but some steep spikes in short run ATM shorts with very shorter term expiries are recommended.

By doing so, one can participate in tiny rallies within 2-3 days' time and it also reduces the cost of hedging because of the initial receipt of premiums. Whereas, strips cost extra by deploying an additional call option in this strategy.

So, purchase 1M 2 lots of At-The-Money -0.48 delta puts and sell 3D or 1w one lot of (1%) In-The-Money put option.

As shown in the diagram, use shorter expiries (2D or 3D) for OTM put writing that funds to the purchase of the greater number of long puts and the position is entered for no cost or reduced cost.

You can also make out from the daily technical charts that bullish sentiments have been active in shorter time frame which is substantiated by both RSI and stochastic curves, whereas on weekly clear selling forces are sustaining.

FxWirePro: EUR/CHF disparity between IVs and premiums - risky traders can prefer back spreads

Monday, December 28, 2015 12:19 PM UTC

Editor's Picks

- Market Data

Most Popular