Technical Watch: On weekly plotting, after three weeks of upswings we traced out a “Long Legged Doji” at 1.0979 (a resembling Shooting Star pattern is popping up at the moment). These bearish patterns evidence the weakness again in this pair, as a result we now see the slumps dropping in the narrow range trend again. The brief upswings were not sustained even though break out above resistance at 1.1016 and drop below the resistance of sideway trend channel.

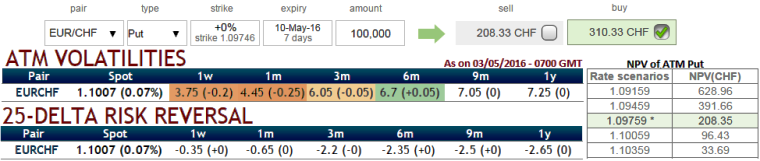

EURCHF OTC observation: From the above nutshell, it seems like there is no traces of volatilities ATM IVs have been lacklustre, declined to 3.75% for 1W expiries and just shy above 6% for 3M tenors, the least among G10 pairs.

It seems like huge disparity exists between option premiums and IVs as the 1W ATM puts have been priced 47% more than NPV which in turn a cause of concern as to whether spot FX would move in sync with risk reversals or not.

While the delta risk of reversal of EURCHF has been one of the most expensive pairs to be hedged for downside risks as it indicates puts have been relatively costlier. This would mean that a downside risk of spot FX is anticipated and hedging for such risks is relatively more expensive.

Hence, contemplating above technical as well as OTC reasoning, even if the technical trend goes adversely to what is anticipated here, the below strategy is likely to derive certain yields as the IV factor is missing here. Such low IV times are rare in OTC markets, one can use this as option trading opportunity.

Option Trade Recommendation: Naked Strangle Shorting

At current spot at 1.0976 with range bounded trend keeping in consideration we would like to remain in safe zone by achieving certain returns though shorting a strangle.

Short 1W OTM put (1.5% strike difference referring lower cap)and short OTM call simultaneously of the same expiry (1.5% strike referring upper cap) (preferably short term for maturity is desired).

Maximum returns for the short strangle is achieved when the EUR/CHF price on expiry is trading at around 1.0840 or between the OTM strike as both the instruments have to wipe off worthless. So that the options trader gets to keep the entire initial credit taken as profit.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX