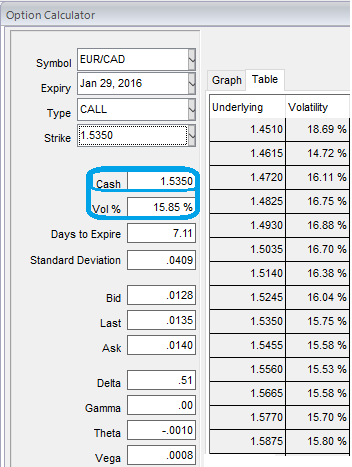

After this week's dovish monetary policy decision from both central banks of euro area and Canada have brought in the more volatility (see diagram for ATM IVs of 18.79%).

Yesterday ECB President Draghi faced a tough task curbing the appeal of the single currency. The euro jump in recent trend is major due to the massive price drops in crude prices to $28 way below the ECB projections for 2016 ($52.2) and the causing drop in inflation prospects present a stern encounter to the divided governing council opinions.

ECB stands pat its monetary status unchanged at 0.05%, the interest on the margin lending facility at 0.30% and the interest rate on deposit facility at -0.30%. The decision has come in in line with the broad forecasts.

The BoC stands pat at its key policy rate unchanged at 0.5% yesterday despite a weaker economic outlook relative to their October forecasts.

Core inflation would be closer to 1.5%, rather than the actual 2.0% pace. Of note, in a break from past MPRs, inflation is forecast to reach 1.9% by the end of the forecast, rather than reaching the 2.0% target.

Hedging Frameworks:

As the pair is likely to perceive higher implied volatility for next 1 week's expiry, the good news for option holders, with the bearish trend to prevail, it is advisable to hold 2W At-The-Money 0.51 delta call and simultaneously hold 2 lots of 1M At-The-Money -0.48 delta put options. Huge profits achievable with the strip strategy when EURCAD exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move. The profitability can be maximized for every shift towards downside and this is not the same on upside.

The delta of this instrument is here at its fastest rate and gets faster as your position come closer to the expiration date. As a result, time decay may have a relevant impact on ATM options.

Please be informed that the trader can still make money even if his anticipation goes wrong - but the underlying pair has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

FxWirePro: EUR/CAD slips lower after central banks’ policy stance - strips best suitable for both hedging and speculating

Friday, January 22, 2016 12:54 PM UTC

Editor's Picks

- Market Data

Most Popular