With no economic releases today in euro area, market focus may start turning to Greece again.

While the Institutions and the Greek government are said to be very close to an agreement on the original and contingency plans, the debt sustainability issue remains a key stumbling block for a deal at Tuesday’s Eurogroup meeting.

Indeed, the IMF and the Eurogroup appear to still disagree on the size, timing and nature of the debt relief measures.

On the flip side, Canada is supposed to release monthly CPI and retail sales numbers.

Technically, as we see more downside potential on this pair as the bulls could not hold onto the this month's highs of 1.4824.

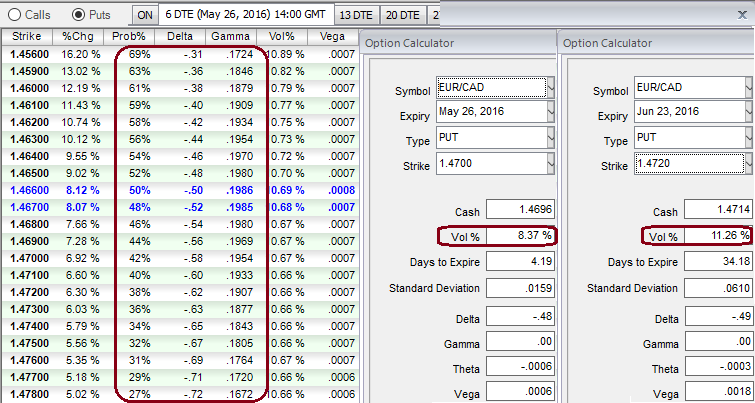

As we were formulating hedging frameworks, we happened to see the implied volatility of 1W ATM contracts are at 8.37%, spiking higher at 11.26%.

We observe Gamma on different strikes are not varying considerably, as we know that the Gamma is the rate of change of the Delta with respect to the movement of the rate in the underlying market. In the Sensitivity table, Gamma shows how much the Delta will change if the underlying rate moves by 1%.

So, a smart approach to tackle such baffling circumstances and potentially profit from volatility is to create a delta neutral position on a security that you believe is likely to increase in volatility.

The simplest way to do this is to buy at the money contracts.

Delta neutral strategies are options strategies that are designed to create positions that aren't likely to be affected by small movements in the price of a security. This is achieved by ensuring that the overall delta value of a position is as close to zero as possible.

Delta value is one of the Greeks that affect how the price of an option changes.

Strategies that involve creating a delta neutral position are typically used for one of three main purposes.

- Profiting from Time Decay

- Profiting from Volatility

- Delta Neutral Values in hedging

The effects of time decay are a negative when you own options, because their extrinsic value will decrease as the expiration date gets nearer.

By writing options to create a delta neutral position, you can benefit from the effects of time decay and not lose any money from small price movements in the underlying security.

The delta of EURCAD would be at its fastest rate and gets faster as your position come closer to the expiration date. As a result, time decay may have a relevant impact on ATM options.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge