Bank of Canada is scheduled on this Wednesday, they held their policy rate unchanged at 1.75% in Governor Poloz’s fourth-from-last decision, a small deceleration in headline CPI with unchanged ‘core’ CPI inflation, and mixed macroeconomic readings on the health of the economy during November.

Ahead of BoC and ECB monetary policies scheduled for this week, EURCAD slips back in Jan trading so far to retest channel support in the low 1.44s. While Growing evidence of economic stabilisation in the Eurozone supports expectations for the ECB to keep policy on hold this Thursday and through the year.

EURCAD remains soft but confined to a range. The EUR has spent the New Year trapped between noted support in the low 1.44 area and resistance at 1.4590/00. Minor gains through the upper 1.45s earlier this month failed to extend and the broader undertone for the cross is starting to look weak again. We still rather think the overall outlook is neutral/positive for the EUR after the late 2019 price action solid weekly and monthly bull reversal signals driven off the 1.44 zone.

But the short-term trend signals are starting to tilt against the EUR somewhat and we think the cross will need to pick up more obviously (above 1.46) sooner rather than later, if it is to avoid further weakness. The pair’s stealthy gains have come to a not so stealthy end, at least for now. We noted the rise in the cross would perhaps need to trade through 1.4750 in order to signal a break out but the EUR failed to hold on to rise through the mid 1.47 area .

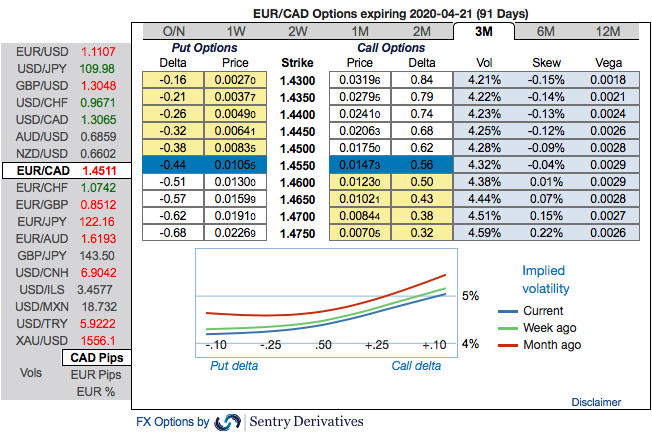

Because of the comatose state of currency markets at present, CAD option risk premia appear oblivious to the fallout of this high stakes standoff. EURCAD risk-reversals in particular appear too complacently priced: at zero across the curve, they are well discounted to already low USDCAD risk-reversals (3M 0.35, 1Y 0.7), and under-priced relative to even tepid recent realized spot- vol correlations (SABR implied 6M spot-vol corr. in EURCAD r/r 1% vs. trailing 1m spot-vol corr 15%).

BoC monetary policy is scheduled for the next week and they are most likely to maintain status quo.

While positively skewed IVs of EURCAD have also been indicating upside risks, bids for OTM Calls are on high demand as the hedging sentiments for upside risks are intensified (refer above nutshell).

Hence, 3m (1%) +0.70 delta in the money call option seems to be the most suitable strategy for EURCAD contemplating some OTC sentiments and monetary policy events.

Alternatively, we advocate shorts in EURCAD futures contracts of February’2020 delivery with a view of arresting abrupt price slumps and simultaneously, add longs in futures March’2020 on hedging grounds for potential resumption of the major uptrend. Thereby, one can directionally position in their FX exposures. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately. Courtesy: Sentry

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal