Markets retain a "risk-on" bias, after US inflation readings came in a little softer than the consensus. US yields came under renewed pressure, as did the USD, while equities benefitted. US President Trump, however, played down optimism about the proposed restart of trade talks with China. We won’t be astonished that foreign traders are interested in hedging the FX risks via high leveraged FX option structures amid the threats of further worsening within EM. While we emphasize that USDJPY vols and USDKRW fwd vols are recognized as worth buying ahead of the tariff decision.

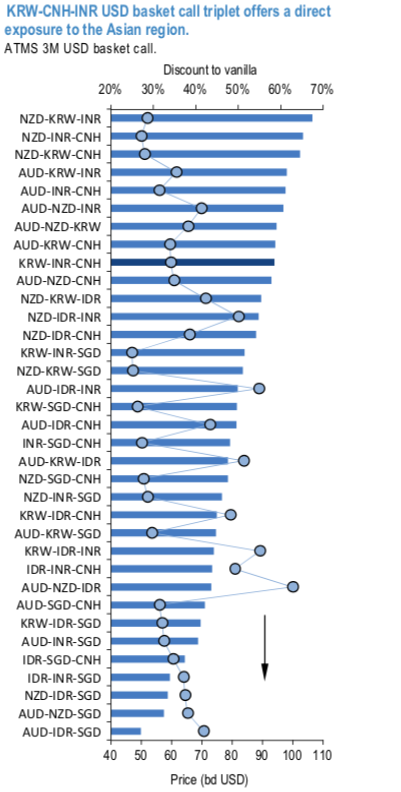

Benefiting from favorable correlation setup, Worst-Of structures serve an efficient way of hedging against further EM vulnerabilities. With the great deal of awareness of potential turmoil eventually set on Asia EM, consequently, USD call baskets of triplets of Asia EM & Antipodeans dollar pairs are emphasized (refer 1stchart).

Well, at 60+% discount in pricing of triplets relative to cheapest outright vanilla, Antipodeans triplets find themselves at the top of the list. Strong commodities link to Chinese economy would make those hedges the favorites if not for the optically already extended move over the past few months.

Only a throw away on the discount ranking, a KRW-CNH- INR USD basket call triplet offers a direct exposure to the region at still very solid discount (58%) to plain vanillas. Even as Asia EM vols have started to broadly firm up, USD basket call is still priced near the recent low (60bp mids for ATMS strikes).

The KRW-CNH-INR triplet’s consistent strong performance since March and historically observed occasional bursts of positive returns that have shown tendency to achieve >7x leverage for ATMS strikes (refer 2ndchart) make a strong case for tactically taking a defensive position in EM via a KRW-CNH-INR triplet. At strikes set to 1%, 0.5%, 1.0% OTMS, USD basket call of USDKRW-USDCNH-USDINR costs 34/42bp for 2M tenor and 44/54bp for 3M tenor. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 34 levels (which is bullish), while hourly USD spot index was at shy above -48 (bearish), CNY at 103 (bullish), while articulating (at 09:39 GMT). For more details on the index, please refer below weblink:

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate