It was then, when EURUSD was about to breach the 1.40 mark to the upside in the spring of 2014 the ECB took action as well, at the time it was first of all Mario Draghi who ended the rise with the help of verbal interventions. Consequently, EURUSD eased to 1.05 until early 2015. Likewise, a strategy now seems to be emerging in the minutes of the meeting of 19th - 20th July.

The first point is that levels around 1.14 (this is where EURUSD traded at the time of the meeting in July) caused the exchange rates to be an issue for the ECB. That is the case as long as one assumes that the minutes (which of course are not the verbatim transcript) were not “re-adjusted” as a result of the recent EUR strength.

Secondarily, let’s shed some light on the minutes about EUR strength. They point-out that the development up to the July meeting was partially due to the positive fundamental data compared with other currency areas. Moreover there is no mention of concerns about a strong EUR but about the exchange rate overshooting. This concern is not unfounded. USD faces a tough time as a result of Trump and the ECB will soon have to explain to the market that it is going to end the assets purchasing programme.

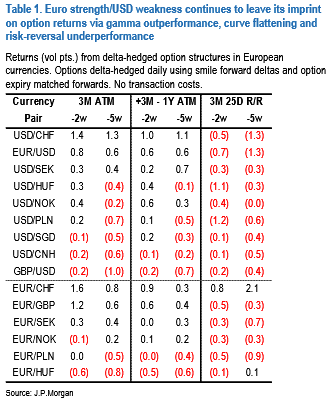

While JP Morgan ponders that the powerful beta-forces of Euro strength and dollar weakness continued to leave their imprint on FX vol surfaces for another week. Gamma continued to outperform, led this time around by the outsized 2.5% w/w move in USDCHF, vol curves remained under flattening pressure and the recent trend of risk-reversals reshaping away from USD calls in favor USD puts stayed intact following a dovish-leaning FOMC statement (refer table).

Realized vols may cool a tad from here as the event calendar eases from here on out till late August, but we are of the view that front-end vols will stay well-supported as (a) August in general tends to be a seasonally strong month for volatility, and (b) investors seem inadequately invested in the bullish Euro trend judging from the breadth and intensity of spot rallies and counter-conventional spot-vol correlations so far, so directional option demand is likely to remain robust.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure