We have received two surprises to reduce downside risks to USDJPY.

One is from politics and the other is from the macro side:

With respect to politics, we had expected that FX and trade issues would have been discussed at the U.S.–Japan summit held on February 10-11, given the series of fierce attacks on Japan by President Trump before the meeting. Yet, these issues were not discussed while the communique confirmed the two nations are firm allies and the Senkaku islands fall within the scope of Article 5 of the U.S.-Japan Security Treaty. The summit was more than perfect for Japan.

On the macro side, with the chorus of hawkish commentary by the Fed officials, the market has priced in a March hike immediately. Given that, widening U.S.-Japan yield spreads have brought USDJPY higher and the pair is now reaching the upper end of its trading range since mid-January.

We now expect the Fed to deliver three hikes in this year (Mar, Jun, and Sep vs. May and Sep previously).

Driving forces for bullish/bearish scenarios:

USDJPY to 125 if 1) Strong US growth leads more aggressive Fed hikes, 2) Japanese fiscal policy becomes more expansionary, resulting in higher Japan’s inflation expectations.

USDJPY to 100 if 1) The global investors’ risk aversion heightens significantly, 2) Weak US economy dampens hopes for Fed hikes, 3) The U.S. administration talks down USDJPY aggressively.

Potential triggering events:

Econ. Min. Seko meets Ross (Mar 16)

BoJ meeting (Mar 16)

G-20 (Mar 17-18)

USTR report on trade barriers (end-March).

Hedging Framework:

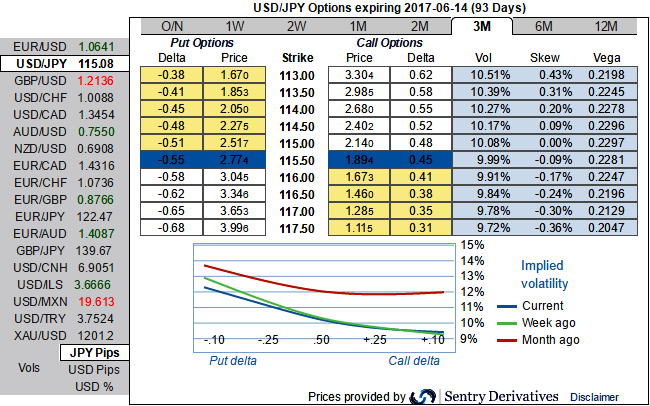

The positively skewed IVs of 3m tenors are indicating the hedgers’ interest in OTM put strikes. With bearish-neutral risk reversal in this tenor, we wouldn't be surprised even if the underlying spot FX evidences the interim spikes ahead of above mentioned Fed hiking cycle, but the below option strategy to optimally arrest any abrupt slumps towards 112.169 and 111.450 levels sooner or later.

Hence, we deploy ITM puts with longer tenors in our option strategy as the delta risk reversals favor bearish targets, hence in order to keep the risks on either side on the check we reckon diagonal debit put spreads are best suitable as the IVs and premiums are reasonable considering daily swings on technical charts.

So, here goes the strategy, Diagonal Debit Put Spread = Go long 3m (1%) ITM -0.49 delta Put + Short 1m (1%) OTM Put with lower Strike Price with net delta should be at around -0.40.

For a net debit, bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action