Kiwi dollar should run down again on rate solidity from both sides as the Fed hikes and RBNZ eases another 50 bps (only 25 bps is priced).

The material deterioration in current account deficit from -3.5% to -6% or -7% (just shy of the record -8%) on a low household saving rate and falling dairy prices.

The Chinese growth slowdown and weaker commodity prices to factor in H1.

Although policy de-synchronization will remain a headwind for NZD as short rate differentials compress further, the new thematic for NZD in 2016 is the prospect of a material deterioration in the current account deficit. Thus, the risk bias to antipodean currencies remains firmly to the downside in 2016.

NZD/USD hedging frameworks:

The risk bias to antipodean currencies remains firmly to the downside in 2016.

Well, long-term investors don't get bull trapped in this pair as it is clearly dipping within a southward channel that has moved way below 21DMA with both leading and lagging indicators signal sell in long term.

Hence, we are bearish on NZD for 2016 and forecast NZD/USD at 0.59 by Q1 of 2016 and 0.61 by Q4 of 2016.

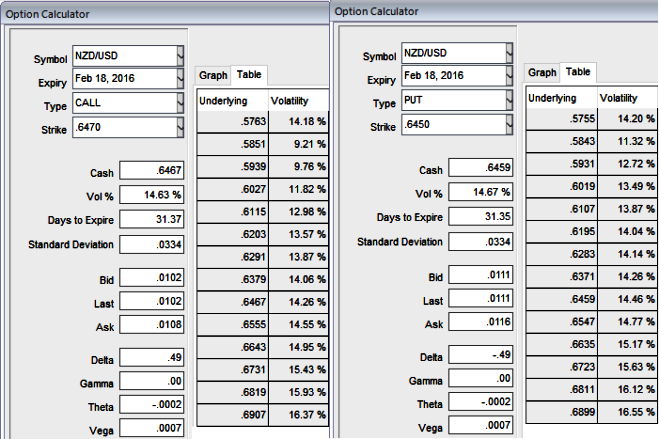

Retrospectively, bearish hedging instruments look expensive (puts obviously tend to be costlier), anticipating the above vital fundamentals we build neutral calendar combinations on this pair hedging potential downside risks.

Employing tailored calendar combination using ATM call shorts at current juncture is more suitable considering when puts seem overpriced.

Here, idea is not to go against the trend but on hedging grounds, strategy goes this way:

Since Kiwi dollar's long lasting bears back in action, the recommendation is to buy 2m (mid-month) at the money -0.5 delta put and simultaneously short 1w near month contract (1%) in the money call with positive theta value.

When IV shows no disparity between calls & puts (around 14.60%) which is on higher side, ATM contracts seems to be overpriced (call premiums trading 15.10% more than NPV, while puts are at 14.44%), as a result with trend being bearish shorting calls would finance the long positions in puts.

FxWirePro: Driving forces of NZD in 2016 – delta combinations serve long term hedging objectives

Monday, January 18, 2016 7:41 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal