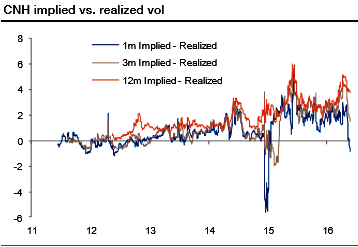

The premium of implied volatility to realized has fallen across tenors; most notably at the front-end where the 1m spread has declined by 2.5 vol points (now in negative territory) and in 3m which is 3 vol points lower from the recent high.

Further out the curve, the gap between 1y implied and realized vol is down 1.1 vol points but still remains elevated on a historical basis. This suggests continuing to favor short volatility structures that benefit from RMB weakness.

Since the depreciation phase in 2014 it has been a rare occurrence for CNH to trade at a premium to CNY.

CNH premium over CNY is 50bp (i.e. USDCNH is 50bp lower than USDCNY), while CNH vol is only slightly higher than CNY (0.2-0.3 vol points).

In the 1-3m tenor it is cheaper to short RMB via CNY NDF’s (100-300bp) but from 6m-12m the differential is lower (30-50bp) and under the expectations that CNH will return to a discount to CNY, long USDCNH is more appealing at longer horizons.

Zero cost/small premium option structures can be devised (buy USDCNH call vs sell USDCNY call -equivalent topside strikes) to position for CNH returning to a discount to CNY. Risks are, namely,

1) The premium and 2) The CNH/CNY basis if spot trades above the topside strike.

Alternatively, we kept reiterating the ownership in a 1-year USDCNH seagull structure (USDCNH call spreads against selling a downside put strike) is appealing.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation