As the pair drags upswings near 0.9800 levels which is a stiff resistance at that juncture, medium-term pullbacks are seemingly still well supported by DMAs.

While these levels hold the trend we have been witnessing dips from the last couple of trading sessions or so, but 0.9597 region remains intact as the major support and is adding further cushion.

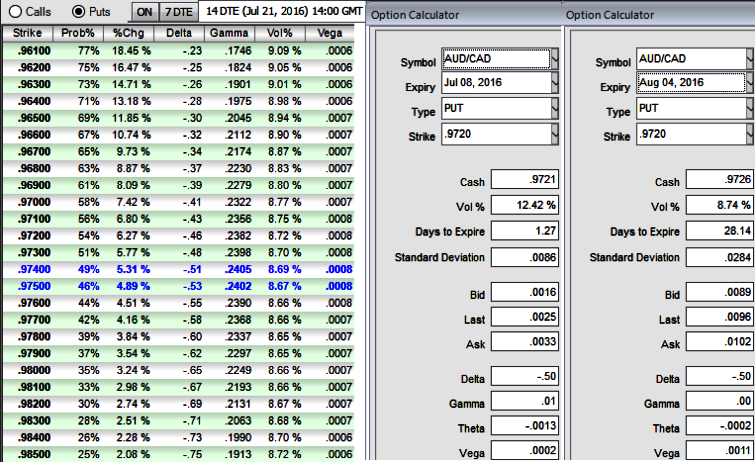

There has been a tremendous shrinkage in IVs from 1w tenors to 1m tenors, a massive decline from 12.42% to 8.74% which is good news for option writers. Thus, we can concentrate on option strategies that derive net credits into the FX portfolios.

FX option strategy: AUDCAD

Well, keeping the above technical factors in mind, it is advisable to go long in 1M (0.5%) OTM 0.38 delta call while writing 1W (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when the AUDCAD spot price is anticipated to drop moderately in the near term and spikes up in long term.

Trader expects that the underlying spot FX price would drop to ITM strikes on expiration and thereafter bounce back again.

Thereby, you are speculating the spot AUDCAD’s struggle in the short run by shorting, and lock in any dramatic upside risks caused by cyclical event risk in next two months which is especially from the results of Brexit fears via longs in OTM strikes that is why we've used diagonal expiries.

Margin: Yes for ITM shorts.

Return: The return is limited by ITM shorts. No matter how far the market moves below that point, the profit would be the maximum to the extent of initial premiums received.

Risk: If the underlying spot FX price rises above the strike price of the higher strike call at the expiration date, then the bear call spread strategy suffers a maximum loss equals to the difference in strike price between the two options minus the original credit taken in when entering the position.

Effects of Volatility: We’ve chosen narrowed strikes on shorts side in order to take the IV advantage. When realized volatilities match with our short term anticipations of downswings as per the technical indications, the option writers in this strategy can be rest assured with the credits received in the form of initial premiums on the short leg.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes