Aussie Macro View:

After the RBA’s reassessment of the inflation outlook in the Statement of Monetary Policy, indicators of pricing pressure will gain more importance.

The next key release is the wage price index next Wednesday (18 May).

Labour force (19 May) is also on the horizon. A strong print could drive a reassessment of the RBA outlook and most importantly, the timing of any further cuts.

FX OTC Updates:

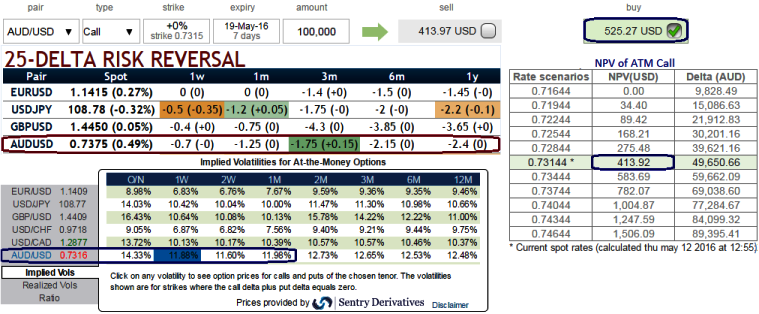

OTC IVs and sensitivity table, we consider 1M ATM IVs at 12.00% at spot FX 0.7332 levels which is still the highest among G10 currency pool and 11.89% for 1W tenors.

ATM call premiums are trading 27.11% more than Net Present Value of these instruments.

As you can observe IVs in next one month’s timeframe likely to stabilize or slightly deteriorate, this would be good news for call option writers as risk reversals signal downside risks while IVs getting stagnant.

If you have skepticism whether AUDUSD to show recovery if Fed keeps deferring its policy decision, it would be better to deploy below option strategy so as to match the OTC market sentiments.

While leveraged accounts remained bullish on commodity currencies, led by the AUD. They raised their net AUD longs by USD0.8bn to USD3.4bn, the highest since Sep 14, this must be puzzling now which is in contradiction with OTC signals.

Hedging Strategy:

Well, contemplating these disparities between option pricing, trend, reducing IVs in long run, RBA’s rate cut probabilities, we subsequently, recommend the “Calendar Spread” on hedging grounds so as to match up with puzzling swings in both short term and long term, so please monitor the following Calendar Setup:

Go Short in near month (1%) OTM call with positive theta or closer to zero

Go Long in mid month (1%) ITM +0.61 delta call

Thereby, net debit is reduced by short side, and the implied volatility as a function of moneyness for a fixed time to maturity is generally referred to as the smile. The volatility smile is the crucial object in pricing and risk management procedures since it is used to price vanilla, as well as exotic option books.

OTM strikes, rely solely on extrinsic value and have a low Delta, Theta, and Vega. But a move towards the OTM territory increases the ATM Vega, Gamma and Delta which boosts premiums.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX