Macro and OTC outlook:

We look ahead for the BoC to begin tightening monetary policy H2 2016, contributing to a pullback that takes USD/CAD to 1.33 plus at year end. We stress that the lack of a recovery in crude oil (WTI) prices above $50-52 levels remains the most important risk to our CAD outlook from here onwards.

Nonetheless, USD/CAD is unlikely to drop under 1.20 unless oil prices can rally durably beyond $60/bbl, which is not our baseline scenario.

A Fed rate hike in H2 16 and rising expectations ahead of it are expected to support USD/CAD from monetary divergence. An expected plateauing of the oil price trend going forward also eliminates what has been one of the key factors behind CAD strength in the first half of the year. But CAD offers good long-term value and investors should look to fade any sustained weakness in coming months.

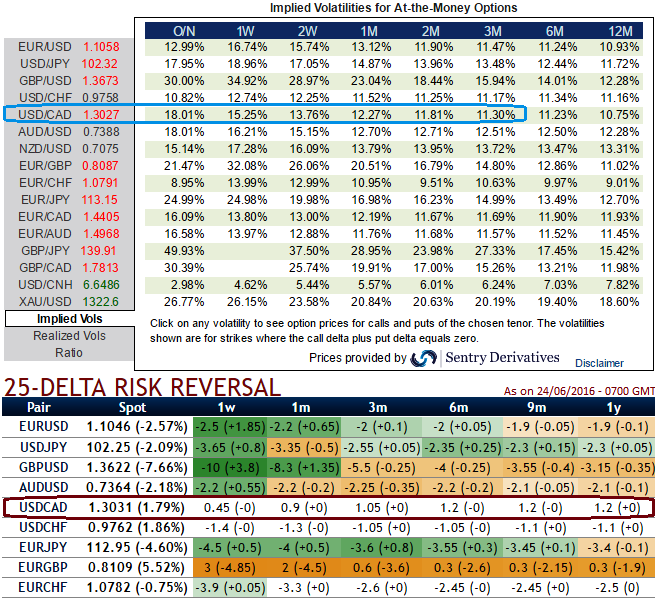

While the bullish neutral risk reversal flashes but negative changes attached to it indicate puts turning out to be more expensive than calls (downside protection is relatively more expensive). Significant changes can indicate a change in market sentiments for the future direction in the underlying forex spot rate as they are calculated considering highly liquid OTM calls and OTM puts.

Hence, we advocate below option trading strategy both hedging as well as speculative grounds.

FX Option strategy: Credit Call Spreads (CCS)

The Execution: Keeping the above both fundamental aspects in mind, it is advisable to go long in 1M (1%) OTM 0.36 delta call while writing 2W (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when the spot FX price is anticipated to drop moderately in the near term and spikes up in long term.

Margin: Yes for ITM shorts.

Return: The return is limited by ITM shorts. No matter how far the market moves below that point, the profit would be the maximum to the extent of initial premiums received.

Risk: If the underlying USDCAD spot FX price rises above the strike price of the higher strike call at the expiration date, then the bear call spread strategy suffers a maximum loss equals to the difference in strike price between the two options minus the original credit taken in when entering the position.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios