The old conflict between what the market expects and what the Fed suggests has been re-ignited. This does not involve a rate hike expected for today which is completely priced in on the market and which therefore constitutes a non-event.

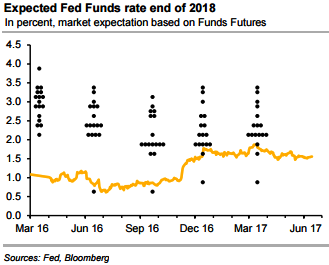

So, what is decisive for USD is the monetary policy outlook beyond today. And that is what Fed and market do not agree on, as the rate expectations until late 2018 illustrate (refer above chart).

Over and beyond today’s 25bp rate hike the Fed expects four further rate steps until the end of next year, the market only one or two.

DXY (US dollar index) which measures the greenback’s strength against a trade-weighted basket of six major currencies, was steady at 96.99. It has been trading in the choppy range from the last couple of days, having no proper direction of the trend with slightly bearish bias.

Ahead of today’s FOMC’s decision on funds rates, although we could see some sort of bearish sensation but the swings could go in either direction with the major trend goes in consolidation phase. Hence, the recommendation goes this way:

Initiate long in 2w ATM +0.51 delta call, and simultaneously buy ATM -0.49 delta put of the same tenor for net debit.

Well, this option trading strategy that is used when the options trader ponders that the underlying gold prices would experience significant volatility but not sure of the direction of the swings.

The overnight volatility has two readings, which are necessary and complementary to read risk event premiums. The directional purpose is related to the straddle breakeven, while the volatility purpose is linked to the realised intraday volatility.

Directional o/n vol: minimal spot return at the end of the day. Volatility is a concept that does not assume a rise or fall in spot, but only the size of the moves. This is why it is relevant to consider potential spot moves either way, which correspond to the breakevens of a straddle (refer above graph). When investors buy an o/n straddle with a directional purpose, they are ready to pay its implied volatility only if they expect the spot to move beyond one of the breakevens. So the implied o/n volatility embeds the minimal spot move that directional investors expect on that day.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation