This pair has been in extremely bullish mood, it is now making every attempts of recovery as both technical and fundamental indications are signaling buying sentiments, we've run through the bullish indications based on technical reasoning in our last post.

Please refer below link for further technical readings:

http://www.econotimes.com/FxWirePro-AUD-JPY-long-entry-triggered-after-clear-confirmation-of-break-out-of-apex-point-117367

http://www.econotimes.com/FxWirePro-AUD-JPY-sustains-bullish-break-out-of-apex-spot-heading-towards-big-targets-at-89297-and-90370-120438

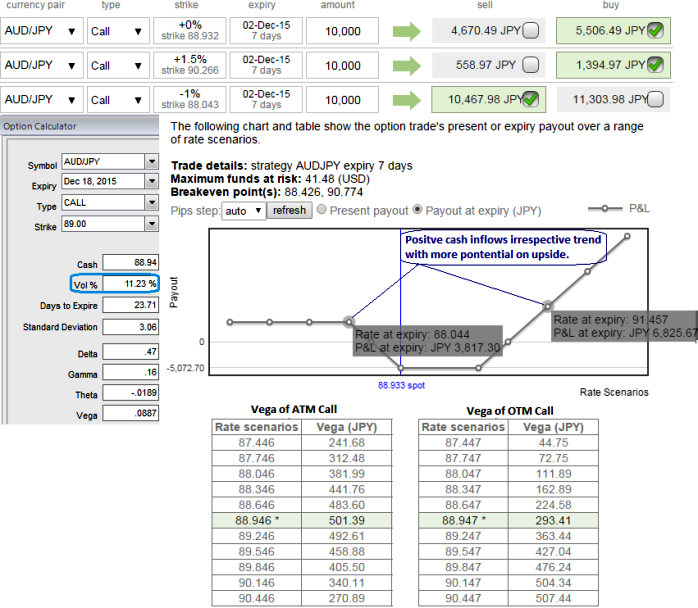

Vega on Long ATM Call = 501.39

Vega on Long (1.5%) OTM Call = 293.41

The current IV of AUDJPY ATM call is higher side at 11.23% which is good for holders and current spot FX is ticking at 88.932, usually if the Vega of a long option position is positive and the implied volatility rises or dips, the above stated option prices are directly proportional to the implied volatility.

So in this case Vega both on long position is reasonably acceptable. It is desirable that at maturity the underlying exchange rate of AUDJPY to remain near short strikes in order to achieve highest returns.

Hence, we recommend it is better to cover all your shorts and employ Call Ratio Back Spread as shown in the diagram purchase 1 lot of 1w at the money +0.51 delta calls and 1w 1 lot of (1.5%) OTM 0.15 delta call, simultaneously short 1 lot of 3d (1%) in the money call with positive theta in the ratio of 2:1.

The purpose of a back spread is to profit on a quick extended move toward, through and beyond the long strike. The purchase of a quantity of more long options is financed by the sale of fewer short options.

The lower strike short calls because IV is inching lower at 11.23% (this is good news for option holders) and it finances the purchase of the greater number of long calls (ATM calls are overpriced, so we chose 1.5% OTM calls as well) and the position is entered for net credit.

FxWirePro: Deploy CRBS on AUD/JPY HY vols

Wednesday, November 25, 2015 7:21 AM UTC

Editor's Picks

- Market Data

Most Popular