Bearish AUDNZD scenarios (likely to dip towards 1.0320-1.0190 levels):

1) The unemployment rate moves back towards 5.75%, raising risks that the RBA responds to a weakening labour market;

2) China data weaken materially; or

3) The risk markets retrace and vol rises.

4) NZ Fiscal easing is delivered quickly;

5) Kiwis inflation expectations begin to ratchet up quickly ahead of the government’s minimum wage increases

Bullish AUDNZD scenarios (likely to rise to 1.1330-1.1420 levels):

1) China eases policy and commodities rebound;

2) The RBA adopts a more hawkish tone to its communications

3) The housing market in NZ slowdown becomes disorderly;

4) The NZ immigration rolls over quickly;

5) NZ bank funding issues intensify, causing the market to question NZ's ability to attract capital inflow.

AU economic data, notable GDP, has recently been strong and supports AUD outperformance. This week’s calendar contains some important data: May NAB business confidence and Apr housing finance (Tue), Jun Westpac consumer sentiment (Wed), and the highlight - May employment report (Thu). RBA’s Lowe speaks Wed.

OTC outlook:

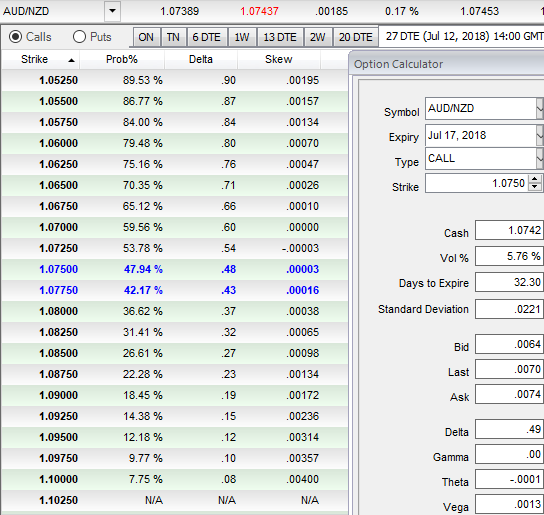

Please observe the above shown sensitivity table of AUDNZD, the skews are stretched on either side. The positively skewed IVs of 1m tenor signify the hedging interest of both bearish and bullish risks.

Option Strategy: Options Strips

Combination ratio: (2:1)

Rationale: Bearish technical environment in the recent past is more imminent, for more insights on this, please follow below weblink:

Contemplating all aspects of fundamental driving forces, technical and OTC outlook, the options strips strategy is advocated on hedging grounds. The options strips strategy which contains 3 legs need to be maintained with a view to arresting price downside risks.

The execution:

Go long in 2 lots of EURUSD at the money -0.49 delta put options of 1M tenors, go long 1M at the money +0.51 delta call option simultaneously.

Description: Traders expect increased volatility without taking a view on any particular direction. A strategy usually utilized over significant economic data events and other political events.

Effect of Volatility: Directly proportionate to the volatility, the value of both options premiums would likely to enhance as volatility increases (good) and will decrease as volatility falls (bad).

Please be noted that the strategy likely to fetch positive cashflows regardless of the swings with more potential on downside. Hence, one can deploy this options strategy on hedging as well as speculative grounds.

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at -124 levels (which is bearish), while hourly NZD spot index was at shy above -123 (bearish) while articulating (at 07:29 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts