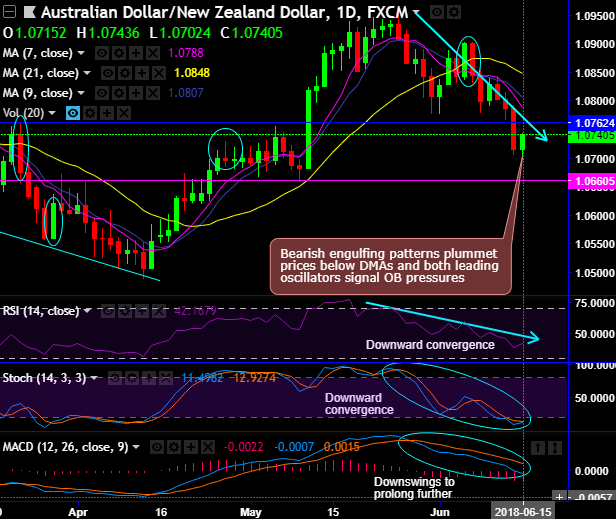

Chart and candlestick patterns formed: Back-to-back shooting stars on weekly plotting and bearish engulfing patterns on daily plotting have occurred signal overbought pressures, while both leading oscillators substantiate the bearish stances.

Bearish engulfing has occurred at 1.0844 and 1.0715 levels (on the daily chart), shooting star at 1.0851 and at 1.0907 levels (on weekly terms).

As a result of these bearish pattern candlesticks, the rallies are constantly dipping that has now gone below EMA levels.

While the major downtrend of this pair has now stuck in the range from last five years or so.

Overall, as stated before the extension of the major downtrend is quite viable at this juncture, even if you witness any abrupt upswings, that shouldn’t be deemed as panicky buying sentiment.

To substantiate this bearish stance, both leading (RSI & stochastic curves) and lagging indicators (EMA & MACD) indicate the downtrend to prolong further.

At spot reference: 1.0739 levels, boundary options strategy is advocated for the intraday speculative trades, use upper strikes at 1.0762 and lower strikes at 1.0702 levels.

The trading between these strikes likely to derive certain yields in this perplexed trend in the short term, more importantly, these yields are exponential from spot movements.

For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 1.0762 > Fwd price > 1.0702).

Alternatively, on hedging grounds, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards 1.6050 levels in the medium run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at -45 levels (which is bearish), while hourly NZD spot index was at shy above -36 (bearish) while articulating (at 06:36 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: