We anticipate the Yen would gain in near term although upswings for the moment are rallying on this pair but any abrupt swings may turn adversely as we think the current uptrend is not that robust and long lasting, so we've tailored our formulation of strategies as the risk appetite varies from different investors to different traders.

Currency Option Strategy: EUR/JPY Short Put Ladder

Rationale: unlimited downside and limited upside profit potential

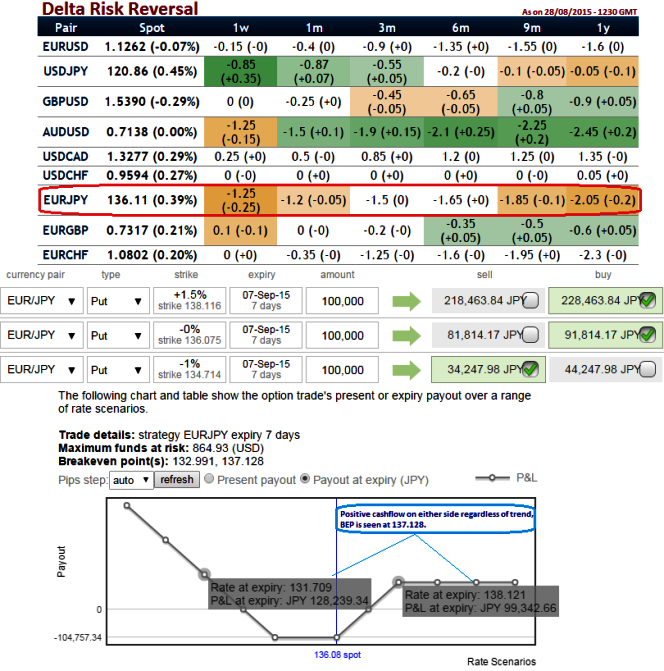

We can observe delta risk reversal for this pair is gradually turning into high negative values, this would mean that market sentiments for this pair have been negative for this pair. Moreover, the pair is likely to perceive implied volatility close to 11% of ATM contracts, thus we recommend deploying short put ladder spreads which is suitable for prevailing significantly higher volatility times.

Maximum returns are limited to the extent of initial credit received if the EURJPY rallies above the upper breakeven point (BEP) but large unlimited profit can be achieved should the underlying exchange rate of EURJPY makes a vivid downswings below the lower BEP.

How to execute: Short 7D (1.5%) ITM put option and simultaneously add longs on 15D ATM -0.49 delta put option and one more 1M (-1%) OTM -0.19 delta put option. The delta of combined position would be at 0.11.

What does this strategy do with current trend: Since the short put ladder is an unrestricted return with partial risk bearing strategy that is deployed because in addition to the puzzling uptrend in short term and downtrend in long-term, we think that the EURJPY would also perceive significant volatility in the near term and delta risk reversal for next 6 months are suggesting downside hedging has been expensive due to selling pressure.

FxWirePro: Delta risk reversal alerts EUR/JPY downside hedging

Monday, August 31, 2015 7:15 AM UTC

Editor's Picks

- Market Data

Most Popular