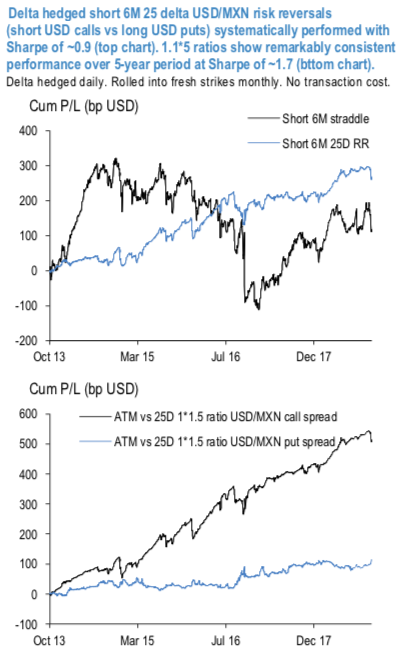

We take the opportunity to analyse what generally works on the MXN vol surface, on a back-tested basis and from a pure vol standpoint. The 1st chart analyses a variety of structures, all for 6M maturities.

For instance, selling RRs (delta-hedged) works orders of magnitude better than selling ATM vol (1st chart - bottom, Sharpe Ratio of 0.87 vs. 0.15 over past 5-yrs). Better yet, 1*1.5 ratio USDMXN call spreads (delta-hedged) have been notably a high Sharpe Ratio (1.66) trade to hold over the years. Being long ATM vs. short OTM calls at near vega neutral notionals, the 1*1.5 ratio call spread structure is also well positioned to be selling topside OTM vols, which now are priced heftily after the latest vol explosion. Also, 1*1.5 ratio calls come near the optimal ratio to maximize Sharpe (refer 2nd chart). At a Sharpe around 0.75, ratio USD put spreads have been decent trades, but nothing remotely close to the ratio USD call spreads.

Buy delta hedged 6M USDMXN 1*1.5 ratio ATMF/25D call spread @15.1 choice vs. @17.1/17.35 indic vols.

Directional 1*2 ratio call spreads and RKO calls: As an equivalent directional expression for those who want to stay short MXN peso 1*2 ratio USDMXN naked (not delta- hedged) call spreads have returned a Sharpe of 1.85 over the past 5-yrs. The trade has a large left tail risk, being exposed to large drops in the peso. USDMXN call RKOs are another expression worth considering, as they efficiently fade rich skews. The structure would benefit from well behaved and contained spot action, but most importantly it carries well defined downside risk (namely, the premium paid).

Buy 2M USDMXN RKO call (20.70/22.00 strike/barrier) for 40bps USD (after 2% stealth), spot ref 20.1928 levels. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR is inching at 37 (which is bullish), USD spot index is flashing at -16 levels (which is mildly bearish), while articulating (at 11:33 GMT). For more details on the index, please refer below weblink:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025