For Swiss Franc, no particular thing is found new with SNB rhetoric. Please be noted the market’s inclination to respond by shifting CHF into the USD and JPY bucket of currencies which will be in snail’s pace or lagged to normalize policy going forward, but the moves have been particularly extreme.

JP Morgan’s analysts have refrained from becoming too dovish SNB for various macro reasons. As such, we would not chase CHF weakness, and continue to prefer to fund EUR longs through USD and JPY. Meanwhile, we continue exploring drivers of broad-dollar weakness this week, examining potential structural drivers that might drive more long-term fair value mean reversion.

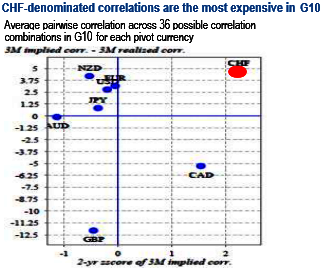

GBPCHF, CHFJPY, and AUDCHF, CHFJPY dual digitals as low premium risk hedges: An eye-catching artifact of the ramp-up in CHF vols is that CHF-denominated (i.e. CHF/X vs. CHF/Y) correlations are now the most overpriced in G10 (refer above chart).

This allows well-geared anti-risk hedges to be constructed in defined premium/ capped loss format via dual digitals that achieve significant gearing even with conservative strike selections by selling elevated corrs.

Since most CHF-crosses are pro-cyclical in nature, decoupling plays require an anti-cyclical counterpart; USDCHF (typically higher in equity market stress) and CHFJPY (lower) are the only two candidates that fit the bill.

Of these, the utility of USDCHF as an anti-risk play is questionable at a time when European cyclical strength is powering EURUSD higher, which leaves CHFJPY as the only available option. In particular, CHFJPY vs CHFAUD and CHFJPY vs CHFGBP are two combinations where implied correlations look particularly elevated currently even vis-a-vis elevated realized, and have a historical track record of consistent de-coupling during vol eruptions (refer above table).

Consider the following as low premium, heavily geared overlays on carry/short-dollar portfolios:

2M [CHFJPY<ATMS, CHFGBP>2% OTMS] dual digitals are indic. offered @ 9.5/13.5 % CHF [individual digitals 45.2% and 31.8% mids].

2M [CHFJPY<ATMS, CHFAUD>2% OTMS] dual digitals are indic. offered @ 10.1/14.5 % CHF [individual digitals 45.2% and 35.8% mids].

Courtesy: JP Morgan

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data