PPP valuation considerations certainly matter more than in the past. In the commodity-driven currencies, the loonie is close to fair value but the risk of a spike higher is greater for it than for the AUD or even the NZD. In particular, the Aussie dollar is mostly overvalued, suggesting that short AUDCAD is an attractive valuation-based relative value trade.

As per the commodity outlook in 2018, crude oil balances will likely tighten pushing oil to the higher end of their range.

In FX, such an oil price breakout was expected to be most meaningful for those currencies where output gaps have already closed and the central bank is normalizing. CAD was thus a prime candidate which we had initiated vs AUD as RBA is expected to remain on the sidelines.

The ongoing structural Chinese slowdown is expected to remain orderly, which should provide reasonable support to Australia’s commodity exports. The commodity strategists see iron ore prices supported above $60/t in 2018, but coking coal prices to decline. There are thus downside risks to the AUD from these factors.

While oil prices have gone up, so have iron ore prices and hence AUDCAD has actually risen since our year-ahead outlook was published on November 22nd.

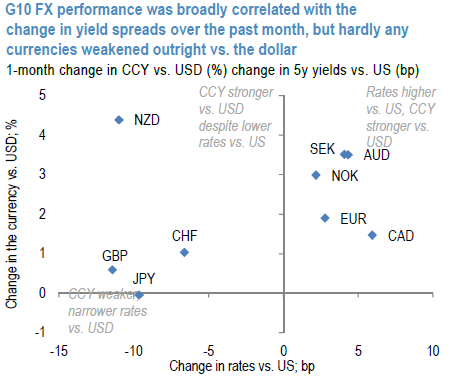

However, as noted in the above chart, CAD seems to have lagged the recent move in rate differentials and moreover, recent data has improved with the latest employment report showing the unemployment rate at its lowest in more than two decades.

Higher oil prices typically tend to translate into even better economic momentum in Canada typically with a lag. A final observation is that CAD is screening cheap adjusted for rate differentials and commodity prices like AUD and NZD. This mispricing is particularly large vs. NZD which we are short elsewhere in the portfolio (NZDCAD is 2.5 sigma too high which has resulted in a correction 85% of the times in the past five years.

Long a 6-mo 0.9450-0.9120 AUD put/CAD call spread. Paid 0.74% November 21. Marked at 0.40%.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms