WTI crude Oil pared some of its gains on the strong US dollar. It hit a low of $84.02 yesterday and is currently trading at $84.84.

According to the American Petroleum Institute, crude inventories rose by 4.09 million this week from 3.034 million barrels the previous week.

Major factors for crude oil price movement-

US dollar index (Bullish)- negative for Crude. Major resistance - 105.20/106. Major support- 103.80/103.

Geopolitical tension- Escalation of tension between Israel and Iran (Positive for crude)

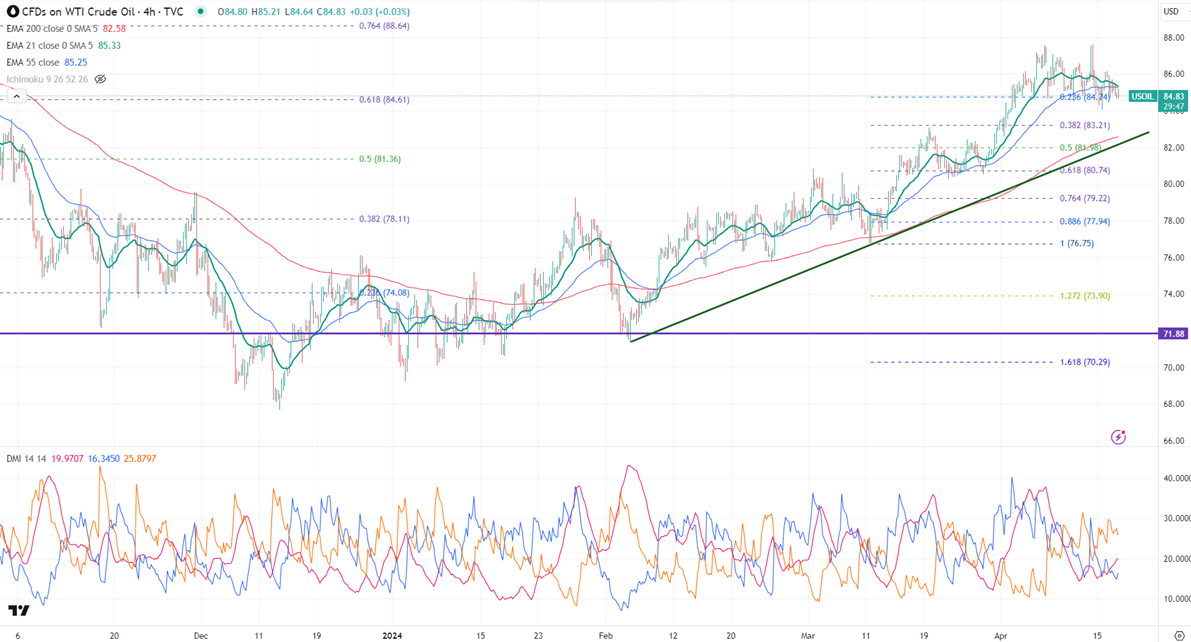

Ichimoku analysis (4- hour chart)

Tenken-Sen- $85.41

Kijun-Sen- $85.81

The immediate resistance is around $85.50. Any jump above targets $86.40/$87.20. On the lower side, near-term support is around $84. Any breach below will drag the commodity down to $83.20/$82.

It is good to buy on dips around $84 with SL around $83 for a TP of $87.20.