The US is maintaining to get on top of the pandemic. The direct effects on US consumers and producers have all been widely discussed. Perhaps the US society will to accept the number of infections and death tolls. That means for now it is not certain that the dollar will suffer. On the other hand, tensions between the US and China and an absence of clear direction concerning the much-awaited fiscal package are likely to keep gains limited.

Amid all these lingering apprehensions, the prevailing global crude oil futures prices have eased a bit owing to the data from some M&A activity, WTI crude is currently trading at $41.41 levels (while articulating).

This week marked the revival of M&A activity in the US light oil space with Chevron’s announced acquisition of Noble Energy, creating an increasingly more diversified global portfolio for Chevron while also picking up acreage complementary to its own portfolio in the lower cost, higher productivity Permian basin in the US suggesting that the U.S. stockpiles rose by more than forecast last week. With WTI is edging higher $26 a barrel and Brent futures inched shy above $30 a barrel.

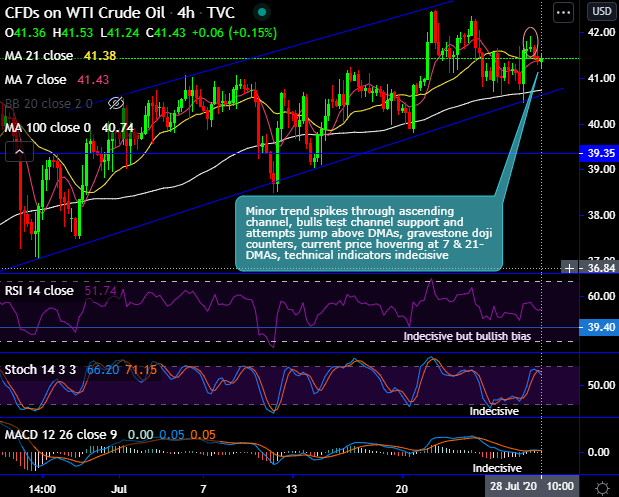

Technically, WTI crude’s minor price trend develops ascending channel pattern after testing channel support of $40.47 levels. Consequently, the bearish journey halts at that juncture and interim upswings resume from there onwards.

While the leading oscillators substantiates the strength in the rallies, the current price is hovering at 7 & 21-DMAs, jump above likely to expose more price rallies, failure swings will resume downtrend.

On a broader perspective, although we see consolidation after bottoming out at the negative territories, any failure swings below 21 & 100-EMAs, may retrace towards 76.8% Fibonacci levels of 2018 highs in this journey (refer monthly chart). The current price jumps above 7-EMAs but cannot declare that as the trend reversal.

As a result, we now expect oil demand to remain unchanged compared to 2019 levels at 99.5 mbd during 2020. This amounts to a sharp downside revision compared to earlier expectations for 0.76 mbd growth y/y in 2020.

Hence, we advocated shorts in CME WTI futures contracts of far-month tenors with a view of arresting any abrupt dips, we would like to uphold the same strategy by rolling over these contracts for August month deliveries.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?