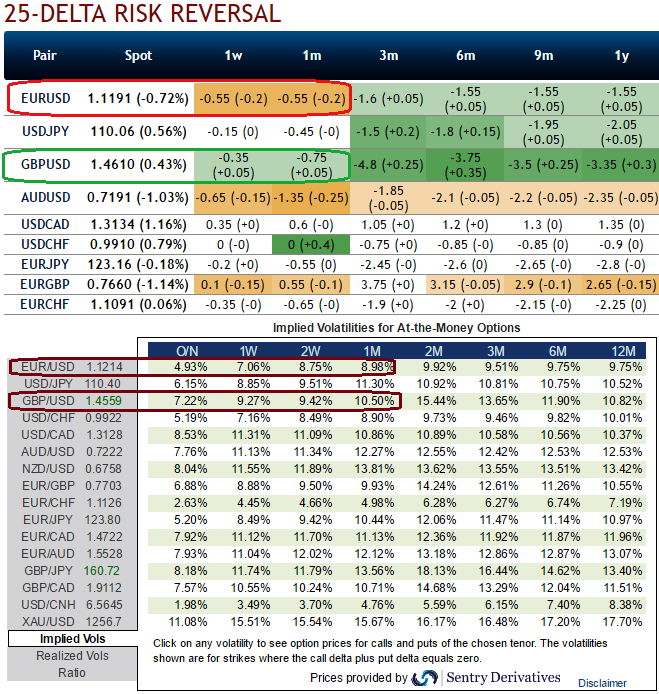

Before we begin with hedging framework let's once glance over OTC updates as to why do we prefer cross hedge between these pairs, we are particularly emphasizing on 1m risk reversals.

Please be noted that the risk reversals of EUR/USD of 1w to 1m tenors are signalling overpriced puts as they print negative flashes, while GBP/USD of 1w to 1m tenors signal positive to neutral hedging sentiments, as a result calls seem to be on higher demand.

The usual reason why cross-hedging happens is that because of the price difference or inability to find right derivative contracts on the same underlying whose risk needs to be hedged in any of the exchanges. Also this happens when the liquidity of these contracts is not really that great.

Well, let’s now visualize a trader decides after seeing above OTC nutshell for in the near month EUR/USD options that indicates overpriced ATM contracts; therefore he tends to short the volatility. And suppose we are shorting an ATM call option with an amount of 100,000 EUR. Currently, 1m IV of EURUSD and GBPUSD is 8.98% and 10.50% respectively.

If the delta is negative 0.5 since this is an ATM EURUSD put option, the amount would be -50,000 EUR in spot outright. To remove this potential risk taking place when the underlying market moves, we can buy 50,000 euro against dollar in the spot market anticipating euro to go up and take the same position in GBPUSD options as it was in GBPUSD.

This allows the delta neutral position. If prediction goes accurate then profit is certain by shorts on call option with nil risk as the market moves around as long as you continue to update the Delta hedge.

But always keep in mind that shorting an option in this case means returns are possible only when volatility falls.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields