Long term Hedging Perspectives:

The risk bias to antipodean currencies remains firmly to the downside in 2016.

Hence, we are bearish on NZD for 2016 and forecast NZD/USD at 0.59 by Q1 of 2016 and 0.61 by Q4 of 2016.

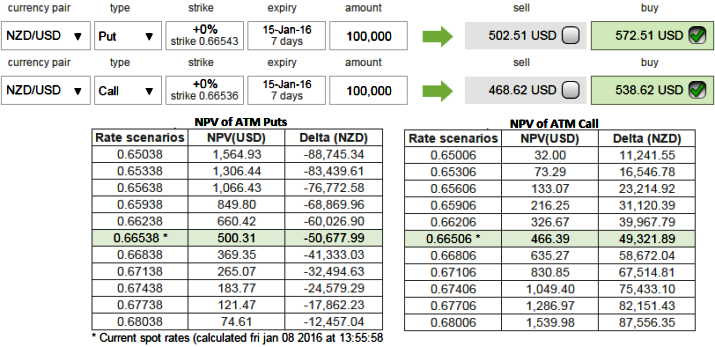

When downtrend in this currency is luring towards further slumps and it is quite natural for bearish hedging instruments look expensive (puts obviously tend to be costlier), on a long term perspective, contemplating the above vital fundamentals we build neutral calendar spread on this pair favoring potential downside risks.

Deploying customized calendar combination using ATM call shorts at current juncture is more suitable considering when puts seem overpriced.

Here, idea is not to go against the trend but on hedging grounds, strategy goes this way:

Kiwi dollar after a long lasted losing streak that was started from last 1 year or so to hit almost 6 year's lows has now changed its direction. Buy 2m (mid month) at the money -0.5 delta put and simultaneously short 1w near month contract (1%) in the money call with positive theta value.

When IV is on higher side, ATM contracts seems to be overpriced (call premiums trading 15% more than NPV, while puts are at 14.22%), as a result with trend being bearish shorting calls would finance the long positions in puts.

FxWirePro: Cover NZD/USD longs to build long term hedging with diagonal delta combos

Friday, January 8, 2016 8:36 AM UTC

Editor's Picks

- Market Data

Most Popular