Gold -

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $2059

Kijun-Sen- $1978

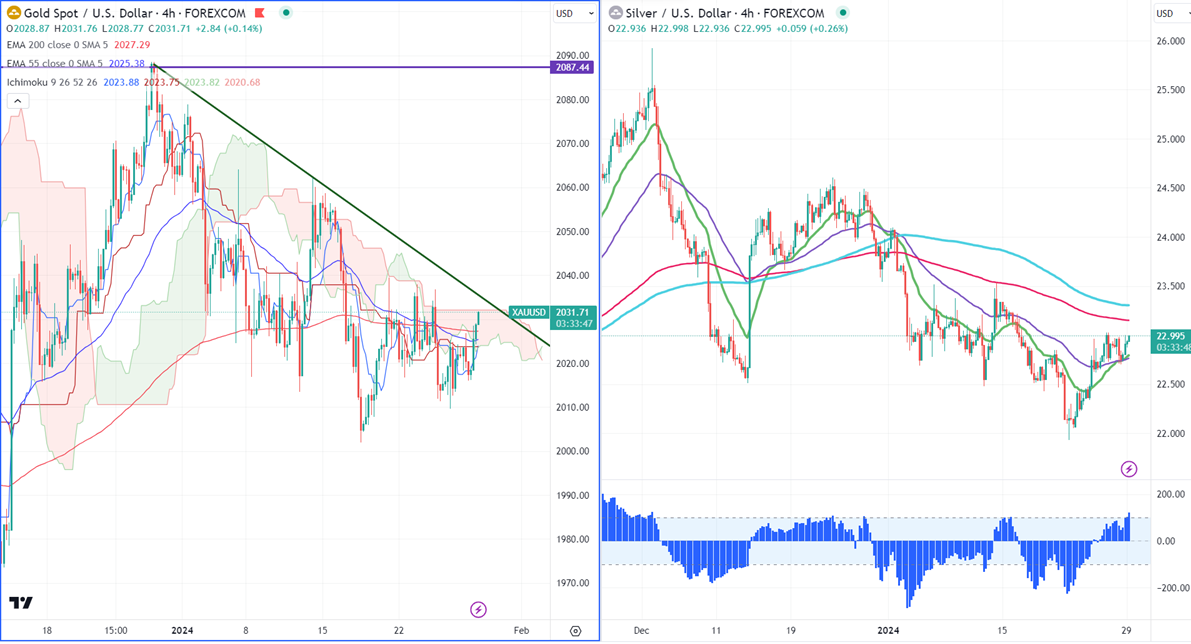

Gold trades in a narrow range between $2037.90 and $2009.40 for the past four days. US Advance GDP grew at a faster pace at 3.3%, compared to a forecast of 2%. US durable goods orders came unchanged in Dec. The Core PCE rose by 2.9% last month from 3.2% in Nov. The central bank kept its rates unchanged without making any changes in the policy statement. ECB President Lagarde said "The consensus around the table of the Governing Council was that it was premature to discuss rate cuts," The yellow metal hit a high of $2028 at the time of writing and is currently trading around $2027.64.

According to the CME Fed watch tool, the probability of a no-rate cut in Jan unchanged at 97.9% from 97.90% a week ago.

.

US dollar index- Bullish only if it closes above 103.69 (200-day EMA). Minor support around 103/102.40 The near-term resistance is 103.75/104.50.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - Mixed (Neutral for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $2015, a break below targets of $2000/$1970/$1956. The yellow metal faces minor resistance around $2040 and a breach above will take it to the next level of $2050/$2062/$2078.

It is good to buy on dips around $1988-90 with SL around $1970 for TP of $2065/$2080.

.

Silver-

Silver showed a nice pullback of more than $1 following footsteps of gold. It trades above 21 and 55- EMA and below long-term MA (200- EMA) in the 4-hour chart. Any close above $23.15 (200-4H EMA) confirms a bullish continuation. A jump to $23.60/$24 is possible. It is facing immediate support at around $22.50. Any break below target $21.90/$21.50.

Crude oil-

WTI crude oil prices traded above $78, the highest level since Sep due to the escalation of Redsea tension and upbeat US economic data.

Major resistance- $80/$83.50. Significant support- $77/$74.

Jan 25th, 2024, ECB monetary policy statement (1:15 pm GMT)

Advance US GDP q/q, US durable goods order (1:30 pm GMT)

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms